CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Explaining Bullish Trend Reversals

Learn Forex Trading

Traders can spend countless hours and days looking for ways to enter the financial market. On their journey to discover the ‘Holy Grail’ of market entry, they explore Japanese candlestick patterns, contrarian concepts, the large variety of oscillators, the Elliot Wave theory, and a lot of other technical approaches. Beginners usually learn from oscillators and indicators how to identify entries into the market; the more indicators and oscillators get studied, the more they’re used in trading.

However, a lot of novice traders neglect one of the most important indicators and oscillators out there – price! The price gives you the full picture of the market, factoring in economic, political and geographic variables. A lot of traders who are just starting out find it hard to use the price as an indicator because they don’t have the experience, so they usually cast it aside and put less weight on it. The truth is, price is the greatest indicator – everything else comes second.

As far as the best market entry point goes, most experienced traders already know that it’s the trend reversal. This is the point at which a dominating trend reverses course, signalling a shift in the opposite direction. While forex trading is filled with reversal patterns, for the purposes of this article, I will be discussing three types.

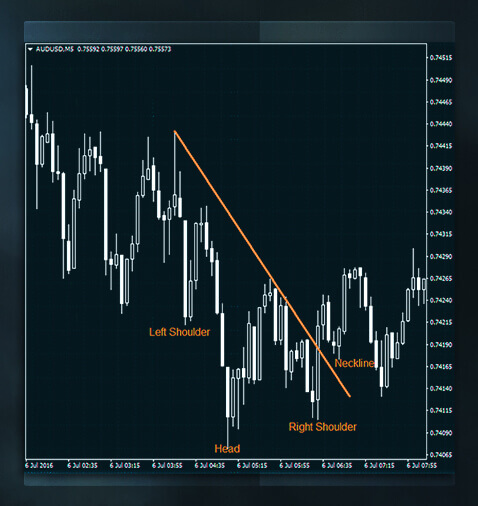

Reversal Pattern #1: Inverse Head & Shoulders

After a succession of lower tops and lower bottoms, there comes a moment when a bottom fails to go lower than the preceding one. This is the critical point when demand overpowers supply, and the market becomes crowded with buyers looking to enter aggressively and push the price higher.

Inverse Head & Shoulders: Seven Things You Need To Know.

- A recognised downtrend needs to exist.

- A downtrend means a succession of lower tops and lower bottoms.

- Where available, volume indicates alerts.

- Where available, decreased volume – associated with a downward move to the head - indicates a warning.

- An imminent reversal is signalled when the right shoulder is greater than the previous bottom (or the head).

- Where available, increased volume – associated with a decisive close above the neckline – indicates the end of a downtrend and the start of an uptrend.

- By projecting the elevation of the inverse head and shoulders pattern to the breakout on the neckline, the minimum price target can be calculated.

Reversal Pattern #2: Triple Bottoms

Similar to the previous reversal pattern, triple bottoms indicate that a downtrend is ending and an uptrend is beginning. Three equal, or nearly equal, bottoms make up this price pattern – together with a definitive close above the resistance (the top) of the formation. It is imperative that prices break over the top of this pattern; otherwise it’s not a triple bottom reversal.

Triple Bottoms: Seven Things You Need to Know

- A recognised downtrend needs to exist.

- A downtrend occurs with a succession of lower tops and lower bottoms.

- Where available, volume indicates alerts.

- Where available, decreased volume – associated with a downward move to the support - indicates a warning.

- The pattern’s support area is formed when the bottoms are equal or nearly equal.

- Where available, increased volume – associated with a decisive close above the resistance – indicates the end of a downtrend and the start of an uptrend.

- By projecting the elevation of the triple bottom pattern to the breakout point, the minimum price target can be calculated.

Reversal Pattern #3: Double Bottom

A downtrend will be in full force, as long as there is a succession of lower tops and lower bottoms reflected in the price action. In this scenario, supply overcomes demand and negative sentiment pushes the prices down to lower levels. Where available, volume would indicate the first sign of weakness if it decreases on its way down. A second warning is signalled when the last bottom fails to move lower than the preceding one. Once the price breaks over the resistance level with increased volume (where available), the double bottom reversal pattern is complete.

Double Bottom: Seven Things You Need to Know

- A previously recognised downtrend needs to exist.

- A downtrend occurs with a succession of lower tops and lower bottoms.

- Where available, volume indicates alerts.

- Where available, decreased volume – associated with a downward move to the bottom – foreshadows an imminent reversal.

- The pattern’s support area is formed when the bottoms are equal or nearly equal.

- Where available, increased volume – associated with a decisive close above the resistance – indicates the end of a downtrend and the start of an uptrend.

- By projecting the elevation of the double bottom pattern to the breakout point, the minimum price target can be calculated.

In Conclusion

There are multiple varieties of bullish trend reversals. Many traders, especially novices, tend to experiment with candlestick reversal patterns and oscillator signals, but they seldom explore reversal patterns that are dictated by price. In reality, price is boss and second to none. Price charts incorporate all external factors, including political, economic and environmental data.

Through price, one understands the psychology of the market and its participants. Thus, reversals with a high probability, are directly based on price patterns that are quickly spotted on the chart. For even better accuracy (and where available), volume – together with oscillator analysis – may be used as further confirmation of reversal patterns.

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.