CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Harmonic Patterns: AB=CD

Learn Forex Trading

Since the introduction of harmonic patterns in Harold M. Gartley’s 1935 book, Profits in the Stock Market, a lot has changed. So it’s inevitable that the original Gartley 222 pattern would undergo some developments as well – after all, the only thing that remains constant is change. Browsing the internet, one comes across many different variations of the original harmonic pattern. What these patterns have in common is the adoption of Fibonacci ratios as a prerequisite.

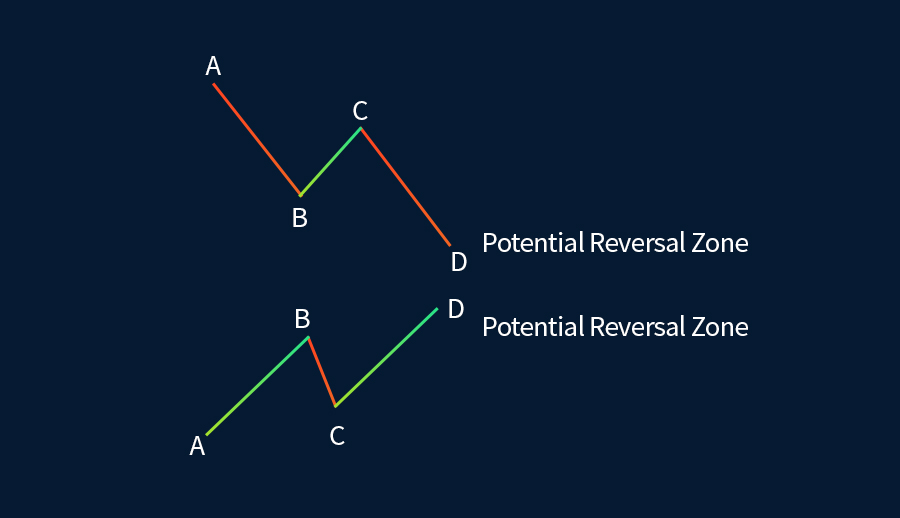

The AB=CD Pattern

One of the authors on the subject, Scott M. Carney, refined the pattern by assigning new elements and specific Fibonacci ratios to confirm the formation. The result is what is known today as the AB=CD pattern.

The Perfect Bullish AB=CD Pattern

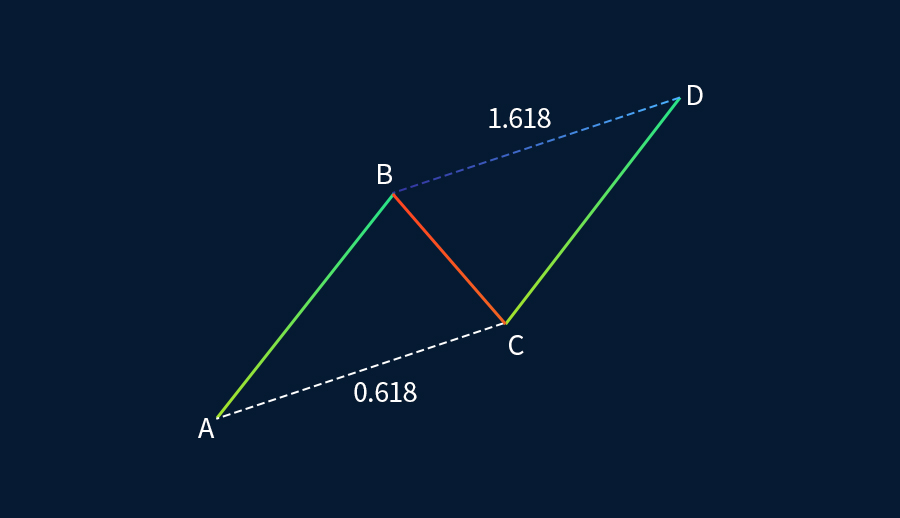

When the structure conforms to the following specifications, then it qualifies as a perfect bullish AB=CD pattern.

The specifications are the following:

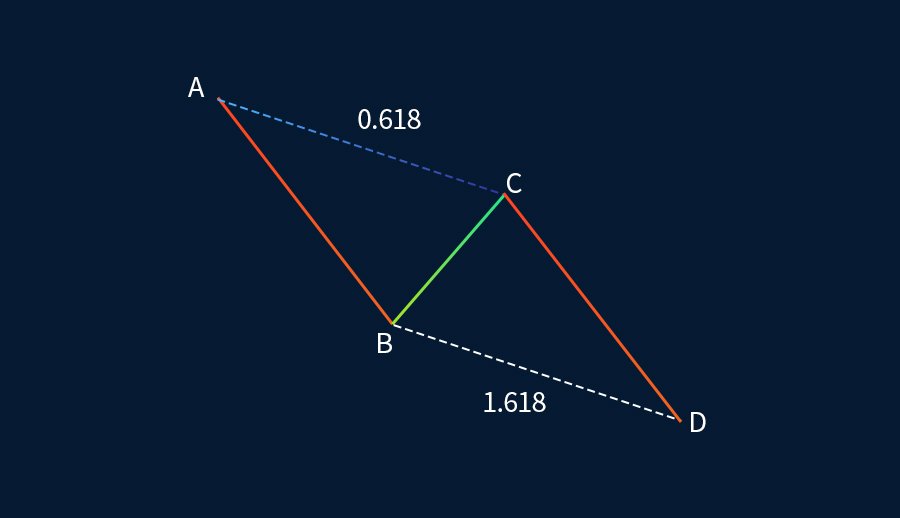

- AB=CD

- BC retraces 0.618 of AB

- CD terminates at the 1.618 projection of BC

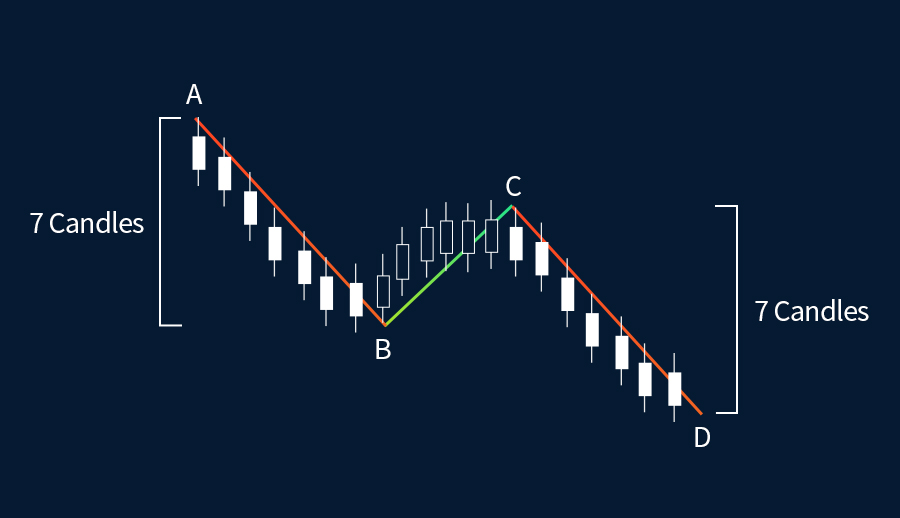

- Equal time of duration for AB and CD

Even though time is not the most reliable factor in technical analysis, it is nevertheless an element of the unique specifications of the perfect AB=CD pattern. One way to measure the time required for each leg (i.e. AB, CD) to complete is to simply count the corresponding candlesticks that comprise each of the legs.

The Perfect Bearish AB=CD Pattern

Similarly, the same rules apply when identifying the perfect bearish AB=CD pattern:

- AB=CD

- BC retraces 0.618 of AB

- CD terminates at the 1.618 projection of BC

- Equal time of duration for AB and CD

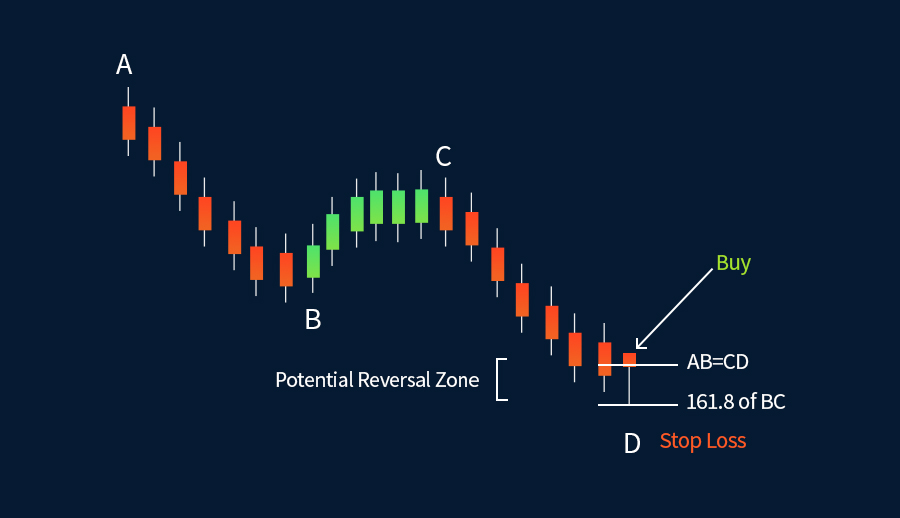

If we take a closer look at a real price chart, we can clearly see that the example below qualifies as a perfect bearish AB=CD pattern.

Point D is defined by the completion of the CD leg that satisfies the condition AB=CD. Also, notice the Potential Reversal Zone which fulfils both required conditions: 161.8 projection of BC and AB=CD. The Reversal Bar, also known as the Terminal Price Bar, tested both lines (161.8 of BC and AB=CD). The only condition that came close, but is not 100% fulfilled, is the time factor. The leg CD took more time to form compared to leg AB. It should be emphasised again that time is not a very reliable factor.

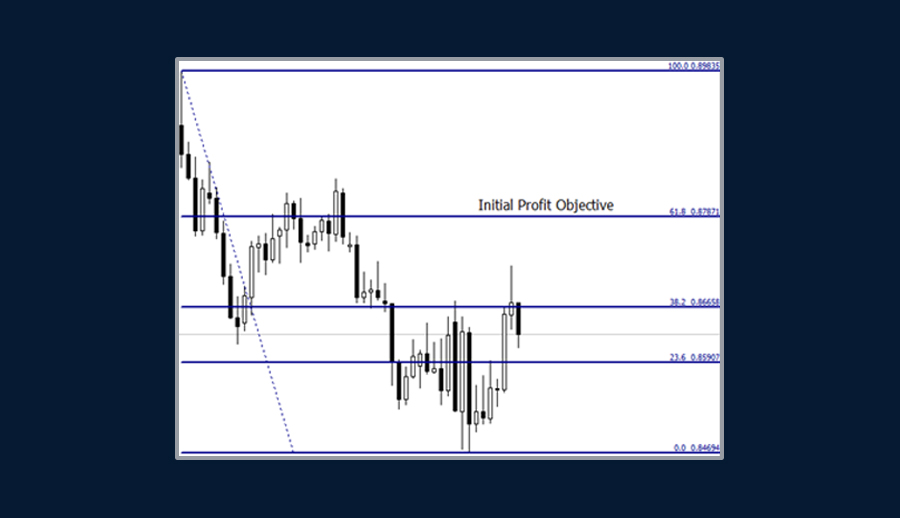

Here is another example of a real price chart; this time showing a bullish AB=CD pattern. Again, all conditions are met, with the exception of the time factor. The CD leg required much more time to complete compared to the AB leg, as this was of a considerably shorter time duration.

Trading the AB=CD Pattern

Trading the AB=CD pattern involves rules for entering the trade, locking potential profits and exiting with minimum loss if the market follows the opposite direction.

The entry in the trade, whether buy or sell, is triggered once the pattern is in place. In the following chart, the completion of the pattern takes place at point D, where AB=CD. Furthermore, the 161.8 projection of BC along with point D define the Potential Reversal Zone. In this case, the Terminal Price Bar hammer-tested both point D and the 161.8 projection of BC. The existence of the hammer at the end of the pattern signals the end of the bearish move and the beginning of a new move to the upside. This is your buy entry.

As no trade is 100% guaranteed to be profitable, it makes sense to place a protective stop loss below the Potential Reversal Zone. After all, the word ‘potential’ implies that the pattern may reverse to the upside or continue following the prevailing trend. If the latter takes place, then the pattern will be invalidated and the buy position will need to be exited.

Take profit is more subjective as it offers different options. An initial profit, usually 50% of the position, may be booked at the 0.618 mark between the high (point A) and the low (point D) of the pattern. The remainder may be booked using a 0.382 trailing stop or trendline violations.

Conclusion

Harmonic patterns have gained a lot of momentum lately. Since their appearance in 1935, many patterns have undergone some refinement. The inclusion of Fibonacci ratios and projections have added more detail to the specifications. This was one of the primary goals of this article — to shed some light on the perfect AB=CD pattern. More articles will follow, and the rest of the harmonic patterns will be unveiled.

Learn to trade with FXTM

Discover how to make the right trading decisions for your style and goals with our comprehensive range of educational resources. Learn from home when and how it suits you with our educational videos or sign up for a remote webinar. We also host on-location, interactive forex seminars and workshops around the world – there might be one coming to your area soon!

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.