What is forex trading and how does it work?

Online Forex Trading: A Beginner’s Guide

Open Account Open Demo AccountThe foreign exchange market, also known as the forex market, is the world’s most traded financial market. Read on to learn how to become a forex trader with our comprehensive Beginner’s Guide.

At FXTM, we are committed to ensuring our clients have the best education, tools, platforms and accounts to trade forex. You’ll find everything you need to know about forex trading, what it is, how it works and how to start trading.

What is forex trading?

Forex trading is the process of speculating on currency prices to potentially make a profit. Currencies are traded in pairs, so by exchanging one currency for another, a trader is speculating on whether one currency will rise or fall in value against the other.

The value of a currency pair is influenced by trade flows, economic, political and geopolitical events which affect the supply and demand of forex. This creates daily volatility that may offer a forex trader new opportunities.

Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC.

What is an online forex broker?

An online forex broker acts as an intermediary, enabling retail traders to access online trading platforms to speculate on currencies and their price movements.

Most online brokers will offer leverage to individual traders, which allows them to control a large forex position with a small deposit. It is important to remember that profits and losses are magnified when trading with leverage.

FXTM offers a number of different trading accounts, each providing services and features tailored to a clients’ individual trading objectives.

Discover the account that’s right for you by visiting our account page. If you’re new to forex, you can begin exploring the markets by trading on our demo account, risk-free.

Why trade forex?

Forex offers many benefits to retail traders.

You can trade around the clock in different sessions across the globe, as the forex market is not traded through a central exchange like a stock market. This means you can jump on volatility, wherever it happens. High liquidity also enables you to execute your orders quickly and effortlessly.

Trading forex using leverage allows you to open a position by putting up only a portion of the full trade value. You can also go long (buy) or short (sell) depending on whether you think a forex pair’s value will rise or fall.

Forex trading offers constant opportunities across a wide range of FX pairs. FXTM’s comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge.

Understanding Currency Pairs

All transactions made on the forex market involve the simultaneous buying and selling of two currencies.

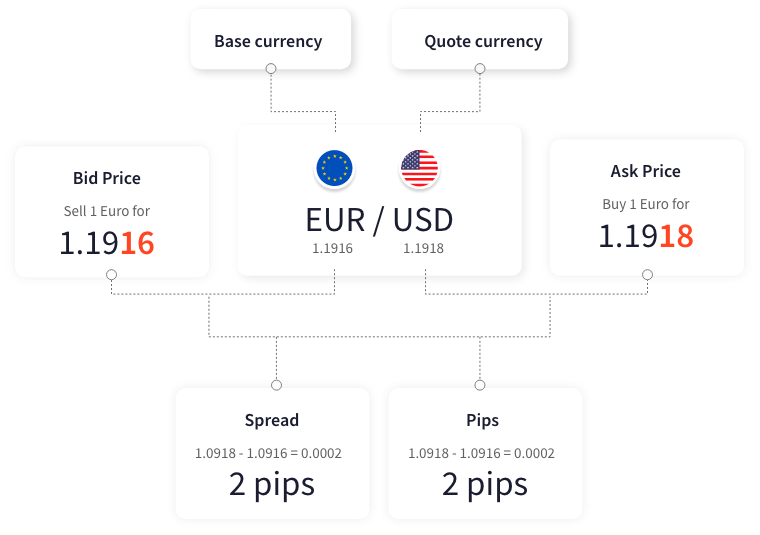

This ‘currency pair’ is made up of a base currency and a quote currency, whereby you sell one to purchase another. The price for a pair is how much of the quote currency it costs to buy one unit of the base currency. You can make a profit by correctly forecasting the price move of a currency pair.

FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the most popular traded pairs in the forex market. These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar.

The table below looks at the most traded currency pair in the forex market.

For most currency pairs, a pip is the fourth decimal place, the main exception being the Japanese Yen where a pip is the second decimal place.

On the forex market, trades in currencies are often worth millions, so small bid-ask price differences (i.e. several pips) can soon add up to a significant profit. Of course, such large trading volumes mean a small spread can also equate to significant losses.

Trading forex is risky, so always trade carefully and implement risk management tools and techniques.

What is a Forex Trader?

A currency trader, also known as a forex trader, will hold a ‘position’ in a currency pair. This is the term used to describe a trade in progress and one that will have a profit or a loss, as the open position indicates the trader has some market exposure.

To represent our positions below, we’ll be using EURUSD trading at 1.1916/1.1918 as an example.

A long position means a trader has bought a currency expecting its value to rise. Once the trader sells that currency back to the market (ideally for a higher price than he or she paid for it), their long position is said to be ‘closed’ and the trade is complete.

So if you wanted to open a long position on the Euro, you would purchase 1 Euro for USD 1.1918. You will then hold your position in the hope that it will appreciate, selling it back to the market at a profit once the price has increased.

A short position refers to a trader who sells a currency expecting its value to fall and plans to buy it back at a lower price. A short position is ‘closed’ once the trader buys back the asset (ideally for less than he or she sold it for).

In this case, if you think the Euro will weaken against the Dollar, you will sell 1 Euro for USD 1.1916 and hold a short position. You expect the Euro to depreciate and plan to buy it back at a lower rate.

What are the most traded currency pairs on the forex market?

There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair.

You can also trade crosses, which do not involve the USD, and exotic currency pairs which are historically less commonly traded (and relatively illiquid). This means they often come with wider spreads, meaning they’re more expensive than crosses or majors.

Major currency pairs

Major currency pairs are generally thought to drive the forex market. They are the most commonly traded and account for over 80% of daily forex trade volume.

There are four traditional majors – EURUSD, GBPUSD, USDJPY and USDCHF – and three known as the commodity pairs – AUDUSD, USDCAD and NZDUSD.

These currency pairs typically have high liquidity, which means they tend to have lower spreads. They are associated with stable, well managed economies and are less prone to slippage, where the expected price of a trade differs from the price the trade was executed at.

Cross currency pairs

Cross currency pairs, known as crosses, do not include the US Dollar. Historically, these pairs were converted first into USD and then into the desired currency - but are now offered for direct exchange.

The most commonly traded are derived from minor currency pairs and can be less liquid than major currency pairs. Examples of the most commonly traded crosses include EURGBP, EURCHF, and EURJPY.

Exotic currency pairs

Exotics are currencies from emerging or developing economies, paired with one major currency.

Compared to crosses and majors, exotics are traditionally riskier to trade because they are more volatile and less liquid. This is because these countries’ economies can be more susceptible to intervention and sudden shifts in political and financial developments.

Fundamental Analysis

This analysis is interested in the ‘why’ – why is a forex market reacting the way it does? Forex and currencies are affected by many reasons, including a country’s economic strength, political and social factors, and market sentiment. Basically, anything you can think of which gives you a clue to the market’s future direction.

News & Economic Data

Investors and banks look for strong economies to place their funds, in the expectation that their capital will appreciate. This is because the currency of that country will be in demand as the outlook for the economy encourages more investment. Any news and economic reports which back this up will in turn see traders want to buy that country’s currency.

Central Bank & Government Policy

Central banks determine monetary policy, which means they control things like money supply and interest rates. The tools and policy types used will ultimately affect the supply and demand of their currencies. A government’s use of fiscal policy through spending or taxes to grow or slow the economy may also affect exchange rates.

Technical Analysis

Forex traders who use technical analysis study price action and trends on the price charts. These movements can help the trader to identify clues about levels of supply and demand.

The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market.

Candlestick chart

This chart is a favourite amongst forex traders, as it shows similar information to a bar and line chart, but arguably in a better way.

The chart displays the high-to-low range with a vertical line and opening and closing prices. The difference to the bar charts is in the ‘body’ which covers the opening and closing prices, while the candle ‘wicks’ show the high and low.

If the candlestick is filled, then the currency pair closed lower than it opened. If the candlestick is hollow, then the closing price is higher than the opening price.

Line chart

A line chart is easy to understand for trading beginners. It simply shows a line drawn from one closing price to the next.

When connected, it is simple to identify a price movement of a currency pair through a specific time period and determine currency patterns.

How to start trading with a forex broker

FXTM gives you access to trading forex as you can execute your buy and sell orders on their trading platforms.

You should always choose a licensed, regulated broker that has at least five years of proven experience. These brokers will offer you peace of mind as they will always prioritise the protection of your funds.

Once you open an active account, you can start trading forex — and you will be required to make a deposit to cover the costs of your trades. This is called a margin account which uses financial derivatives like CFDs to buy and sell currencies.

It is important to remember that trading for beginners isn’t an overnight process. It takes time to become familiar with the markets and there’s a whole new vocabulary to learn.

For this reason, FXTM offer a wealth of resources to learn to trade forex. For example, our Demo account is a great way to experiment with different trading strategies – but with virtual money which means with no risk attached!

Once you’re ready to move on to live trading, we’ve also got a great range of trading accounts and online trading platforms to suit you.

Learn forex trading

FXTM firmly believes that developing a sound understanding of the markets is your best chance at success as a forex trader. That’s why we offer a vast range of industry-leading educational resources in a variety of languages which are tailored to the needs of both new and more experienced traders.

These include Ebooks, daily market analysis, a variety of videos, and more long read guides just like this one!

There are also many forex tools available to traders such as margin calculators, pip calculators, profit calculators, foreign exchange currency converters, economic data calendars and trading signals.

Forex widgets can help to enhance your trading experience. Some of the most popular widgets include Live Rates Feed, Live Commodities Quotes, Live Indices Quotes, and Market Update widgets.

All of this information and resource is designed to help build your confidence to become a more profitable and long-term forex trader.

FAQs

What is trading?

Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit. This is done on a centralised exchange or over the counter (OTC).

How do I learn forex trading?

Learning to trade as a beginner has become much easier and more accessible than ever before. FXTM has many educational resources available to help you understand the forex market, from tutorials to webinars. Our risk-free demo account also allows you to practice these skills in your own time.

How do I start trading forex?

It’s simple to open a trading account, which means you’ll have your own Account Manager and access to hundreds of markets and resources. It is important to understand the risks involved and to manage this effectively.

Is forex trading profitable?

The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose.