Bitcoin Block Rewards

Learn Forex Trading

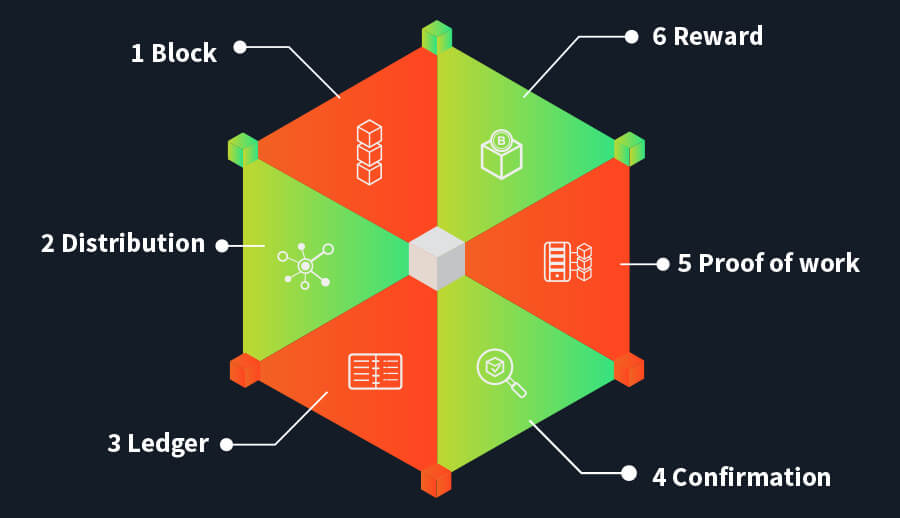

Proof-of-work is one of the more brilliant features of Satoshi Nakamoto’s innovation, Bitcoin. It represents the confirmation of transactions or, more specifically, blocks of transactions.How does Blockchain Work?

Transactions require a “middleman” or central trust that is usually provided by the financial institution. In the cryptocurrency world, and with Bitcoin transactions specifically, this central trust is transferred to “nodes”, or computers connected to the Bitcoin network. In other words, the trust is not centralised anymore, but decentralised and distributed throughout the Bitcoin system.

At the heart of blockchain technology, nodes on Bitcoin’s peer-to-peer network validate and group transactions into blocks. The next step is to include these blocks in the permanent, distributed ledger – that is, the blockchain. In order for a block to be included in the blockchain, a specific task must be carried out: one of the nodes needs to solve a mathematical puzzle, or more precisely, a cryptographic hash.

The Brute-Force Approach

A great deal of computational power is required to solves these puzzles, or hashes. The nodes - also known as miners - have to hash the information in the block (i.e. the block header), in order to satisfy certain conditions. One of the conditions is that the resulting cryptographic hash has to be less than a specific number, or should include a specific number of leading zeros. This is a difficult task to accomplish, as exhaustive trial and error – and a significant amount of energy - is required to reach the target. This method of blockchain puzzle-solving is known as the brute-force approach.

As explained in my Bitcoin Keys and Addresses article, the number of possible 256-bit combinations for a cryptographic puzzle like this is about 1077. That’s why nodes require such tremendous computational power. With blockchain technology becoming more mainstream, we can expect electricity consumption to rise, as these power-hungry, customised devices become more common.

Block Rewards

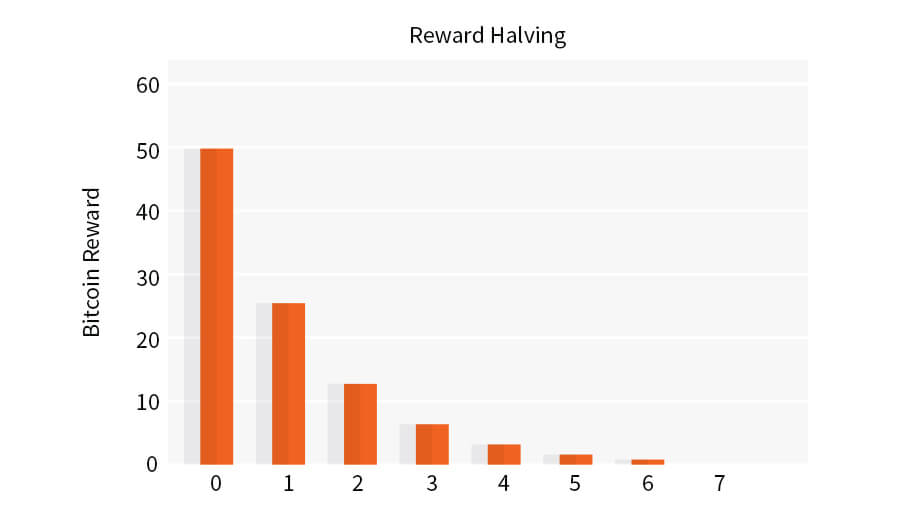

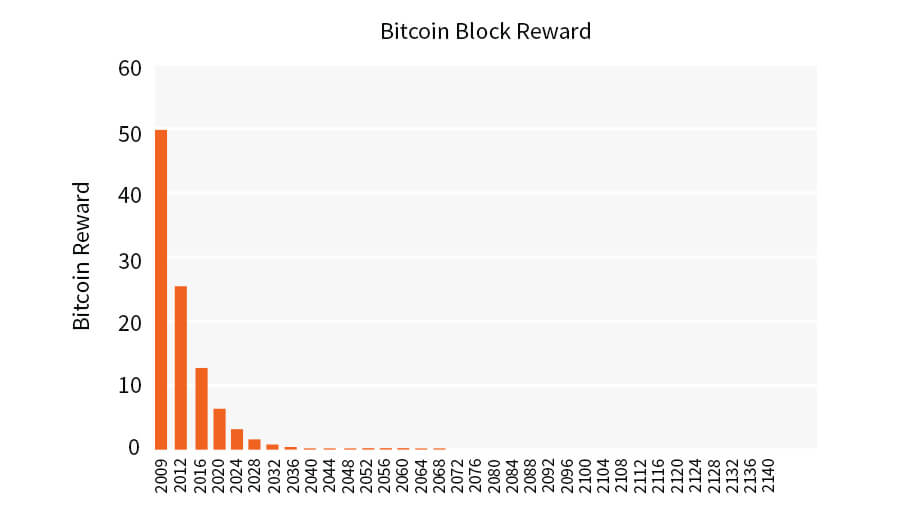

To alleviate these troubles and the expense of excessive power consumption, Satoshi Nakamoto included an incentive in the Bitcoin system. The first node to solve the puzzle would earn a special reward, known as block reward. The very first reward was set at 50 bitcoins (just think how much that is in dollars with today’s conversion rate!). In reality, with the inclusion of every new block in the block chain, the corresponding reward gets created out of thin air.

With this in mind, there had to be a way to control the minting of these new bitcoin rewards. Accordingly, Nakamoto set a limit of approximately 10 minutes before the next block could be included in the blockchain. In other words, a cryptographic hash should take about 10 minutes according to Satoshi Nakamoto. That implies 144 blocks per day, or 52,560 per year. Logic suggests that the more nodes and more powerful computers join the Bitcoin network, the faster the puzzle will be solved.

The ‘Difficulty’ Parameter

To avoid any inflationary trends, Nakamoto included a parameter called ‘difficulty’ in the Bitcoin protocol. The difficulty parameter increases the number of leading zeros in the resulting hash when the nodes solve the puzzle in less than 10 minutes. This ensures that a new block is included in the blockchain every ten minutes or so. As the chart above shows, the reward for solving a cryptographic hash is halved every 210 000 blocks - or approximately every 4 years. The final bitcoin block reward will be awarded in the year 2140.

Previous bitcoin and cryptocurrency wallets articles:

The Origins of the Digital Currency: A Beginning of a Long New Road

Uncovering Bitcoin Transactions: How they Work

Bitcoin Keys and Addresses: What you need to know

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.