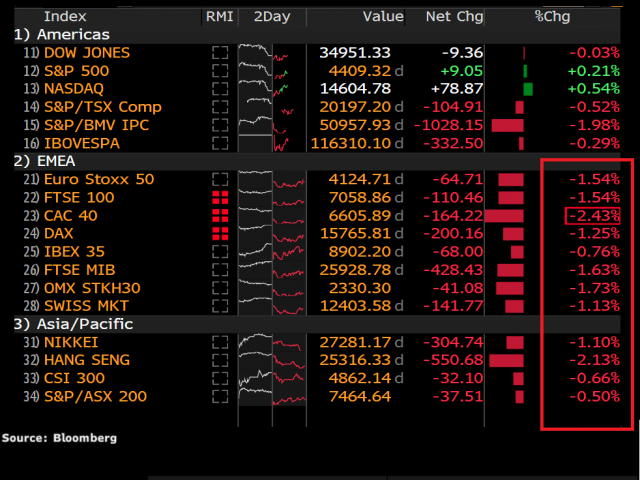

It was not a pretty day for global stocks.

Equity bears trashed the scene as Fed taper fears and concerns around the Delta variant fuelled the risk-off mood. No prisoners were taken with Asian, European deep in the red. US markets had a sluggish start as investors maintained a defensive stance towards riskier assets.

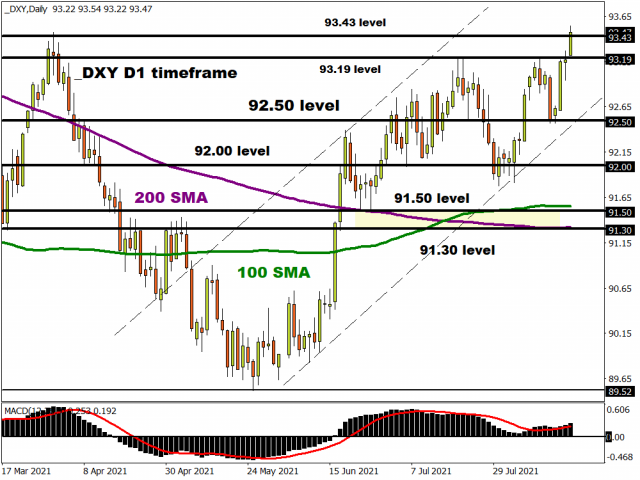

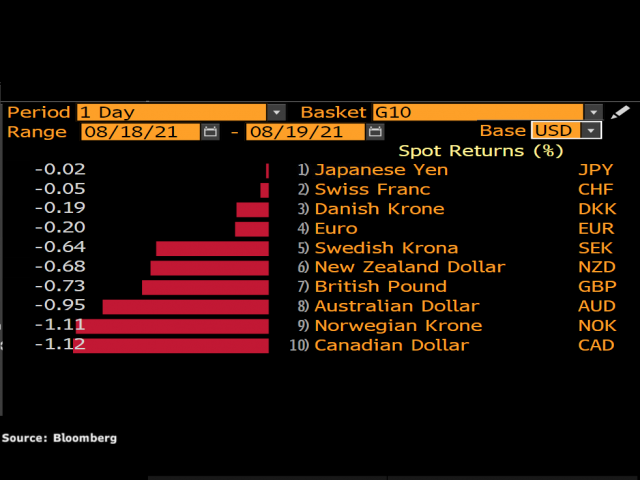

In the currency arena, king dollar jumped to a nine-month high as risk aversion sent investors dashing towards safe-haven assets. When looking at the dollar index (DXY), bulls certainly remain in the driving seat with a solid daily close above 93.43 opening doors towards 94.28 and 94.74, respectively.

As the greenback exerted its influence across the FX space, all G10 currencies were forced to bow.

There were a couple of interesting movers in the equity, forex, and commodities arena today.

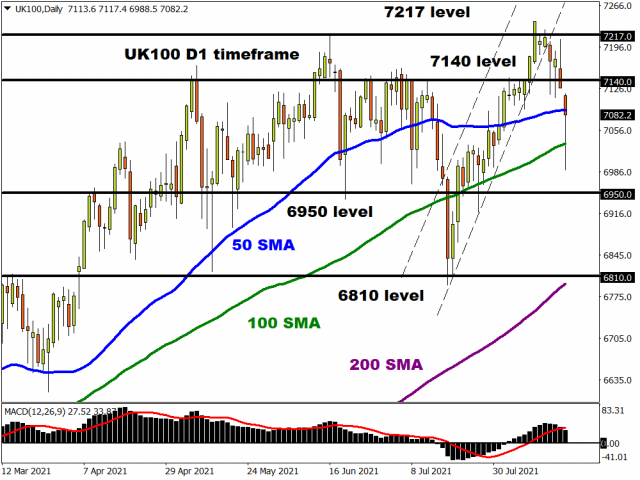

FTSE 100 slumps…

The FTSE 100 closed over 1.5% lower on Thursday. It was treated without mercy by anxious investors as Fed taper fears, concerns over China’s growth, and the spread of the Delta variant soured risk sentiment. Looking at the technical picture, prices have cut through the 50 and 100-day Simple Moving Average. The downside momentum may drag prices towards 6950. A breakdown below this level may open the doors towards 6810. Should 6950 prove to be reliable support, a rebound back towards 7140 may be on the table.

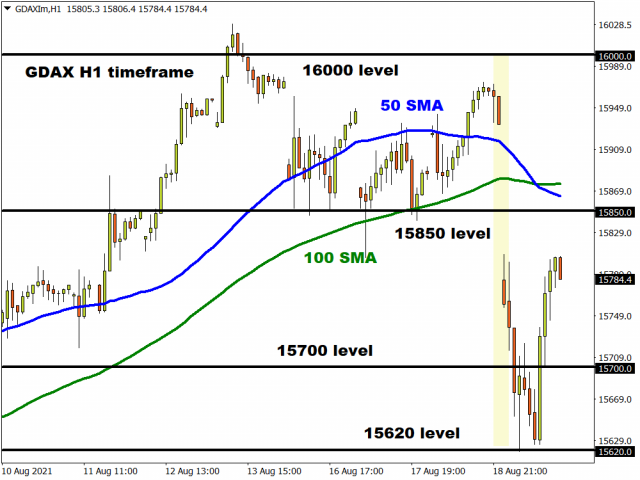

DAX bears in the building?

After gapping lower and closing over 1% lower today, Dax bears have certainly made their presence known. The index remains is under pressure on the daily charts with a breakdown below 15700 encouraging a decline towards 1.5550.

Pound hits 4-week low

Sterling has fallen to a four-week low as the dollar receives a boost from safe-haven demand. The technical picture is heavily bearish with a solid breakdown and daily close below 1.3670 paving a path towards 1.3570. If bulls have any hope of snatching back some control, prices need to move back above 1.3786 which is where the 200-day Simple Moving Average resides.

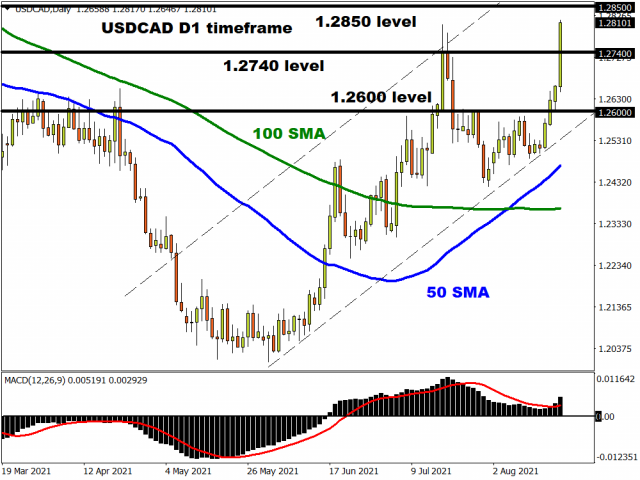

USDCAD explodes higher

Thursday was not a great day for the Canadian dollar which weakened against almost every single G10 currency.

The combination of falling oil prices and concerns over China’s slower economic growth weighed on the currency. Focusing on the technical picture, prices are bullish on the daily charts with the breakout above 1.2740 signalling an incline towards 1.2850. Should 1.2740 prove to be unreliable support, bears may try their luck with 1.2600.

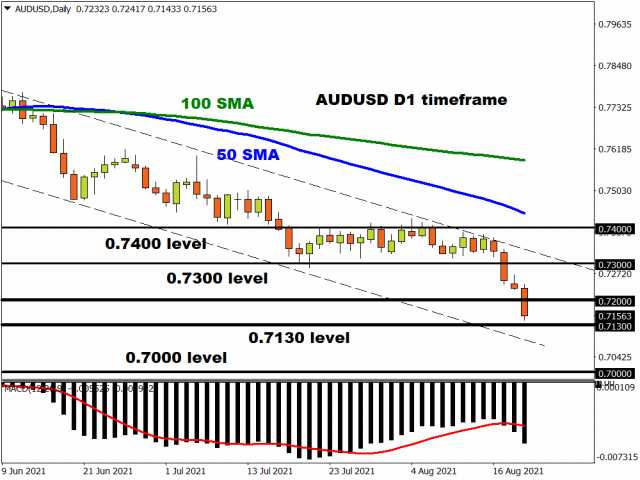

Aussie cuts through 0.7200

This currency pair remains firmly bearish. There have been consistently lower lows and lower highs while the MACD trades below zero. A solid daily close below 0.7200 may inspire a selloff towards 0.7130 and 0.7100, respectively.

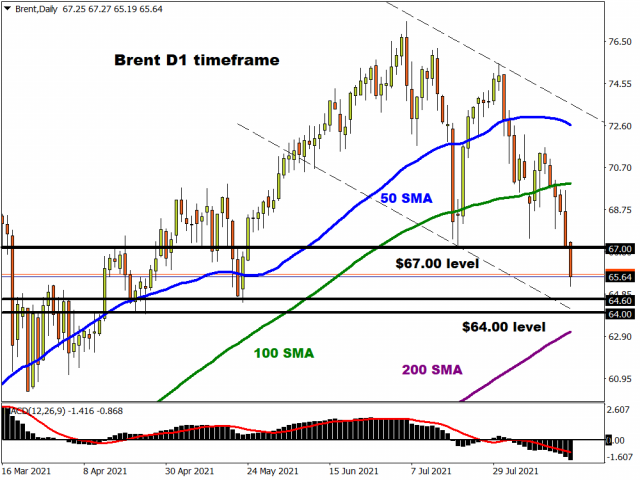

Commodity spotlight - Brent crude

Oil is struggling to nurse the wounds inflicted by Delta variant fears and concerns around the strength of China’s recovery.

Brent is under pressure on the daily charts with price trading below the $67 support level. A solid daily close below this level could give bears the thumbs up to drag prices lower with $64.60 and $64.00 acting as key levels of interest.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.