It was another action-packed week stuffed with central bank meetings and key economic reports from major economies.

Monday kicked off on a positive note as investors put aside concerns over rising interest rates and geopolitical tensions in Ukraine. Markets in China and some other Asian countries were closed for the Lunar New Year holidays. However, European stocks and Wall Street rose higher amid the improving sentiment. On the data front, inflation in Australia surged 3.5% in the final quarter of 2021 while the Eurozone economy expanded 0.3% in the last three months of 2021.

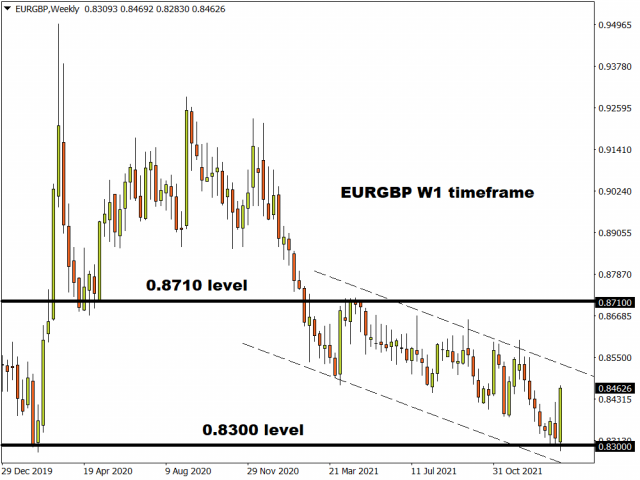

Our trade of the week was the EURGBP. We questioned whether the currency pair was gearing for a breakdown below the key 0.8300 level. Given the policy divergence between the Bank of England and the European Central Bank, the path of least resistance pointed south. Well… despite the BoE hiking rates, the ECB’s hawkish shift threw a proverbial wrench in the works for the bearish setup. The EURGBP staged a strong rebound from the 0.8300 support with prices ending the week above 0.8450.

Early on Tuesday, the Reserve Bank of Australia (RBA) decided to maintain interest rates at its record-low level of 0.1%. The bank stated that it will not increase interest rates until actual inflation is sustainably within the 2-3% target range. Global equity markets kicked off the new month on a firm note after a rough and rocky January. Risk sentiment was lifted by reassuring comments from Fed officials while robust corporate earnings left equity bulls in high spirits. Beneath the market positivity, there was some tension as investors braced for the OPEC+ meeting, Super Thursday and US jobs report on Friday.

Mid-week, we presented a thorough breakdown about why the markets are obsessed with the Fed! So much has been going on across markets with the new year kicking off to a rough and rocky start. You probably have a lot of questions revolving around what the Fed is, inflation, and interest rates among many other things. So, make sure to check out the report which breaks things down into easily digestible chunks.

In other news, OPEC+ agreed to make another modest output increase in March. The cartel stuck with its target of monthly increases of 400,00 barrels per day, even as several members of the group struggled to meet current monthly targets. Both Brent and WTI crude concluded the week hitting fresh multi-year highs, gaining over 20% since the start of 2022.

We also published a mid-week technical outlook that focused on breakouts and breakdowns.

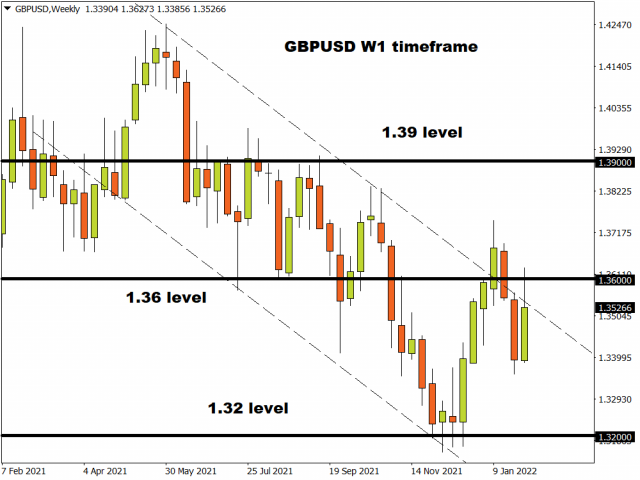

Super Thursday certainly did not disappoint. The BoE hiked interest rates by 25bp in a bid to contain soaring inflation. This was the central bank's second consecutive interest rate increase, the first time its done back-to-back hikes since 2004. Sterling appreciated against the dollar and other G10 currencies following the decision.

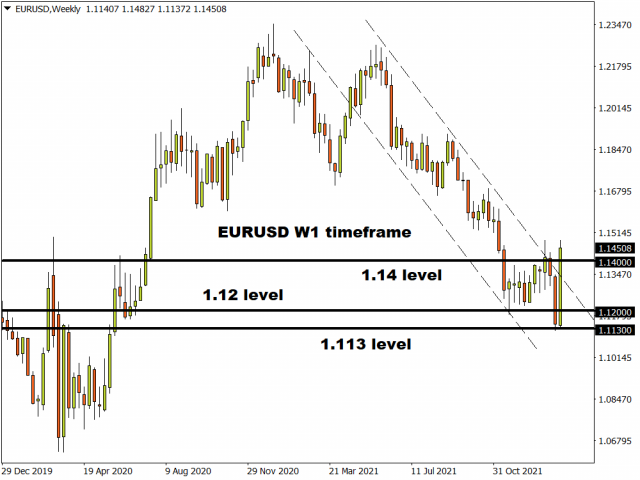

The ECB made a remarkable hawkish shift. Although there were no changes in the central bank’s action, the comments sparked some excitement and discussions. Christine Lagarde refused to rule out raising interest rates in 2022 in response to the ECB’s concern over rising inflation. Given the hawkishness in the press conference, expectations are mounting over the ECB preparing markets for a possible change in the forward guidance at the next meeting in March. The Euro had a positive week, appreciating against most major currencies – gaining as much as 2.6% versus the dollar.

After all the anticipation, the US jobs report was finally released on Friday afternoon. In January, the US economy created 467,00 jobs which were far above the 150,000 expectations. December’s payrolls also had a makeover, revised from 199,000 to 510,000. The US unemployment ticked higher to 4.0% while average hourly earnings were 5.7% higher in January compared with a year ago. This strong jobs report is likely to reinforce expectations over the Fed adopting an aggressive policy path to tame inflation. The S&P500 edged lower following the NFP report, however it still concluded the week roughly 1.6% higher.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.