Markets are quieter today after the full 360-degree about-turn in stocks, which saw bumper gains in those beaten-up companies which had been suffering this year.

As bond yields took a step lower, so we saw a reverse of the value/growth rotation with growth stocks (see Tech!) outperforming value by more than 2%.

The head-spinning day comes on the back of the strong macro outlook, which is forcing investors to reprice central banks, not least the Fed, and also growth projections.

Morgan Stanley increased its estimate for US economic growth to 7.3% from 6.5%, a pace unsurpassed since the Korea War boom in 1951!

The markets must now have priced in the passage of President Biden’s $1.9 trillion economic stimulus package, which of course has heightened inflation expectations and potential central bank action in the near future.

Speaking of which, US CPI numbers just came in and were in line with forecasts as the headline increased to 1.7% y/y.

This three-tenths rise from the prior reading is potentially just a conservative preview of what is to come in the next quarter when inflation will truly be front-page news and is expected to hit 3.5%. This comes partly due to a marked rebound after the pandemic sharply reduced inflation a year ago. The real question is how hot prices run when the economy reopens – is this jump in prices a one-off or more prolonged?

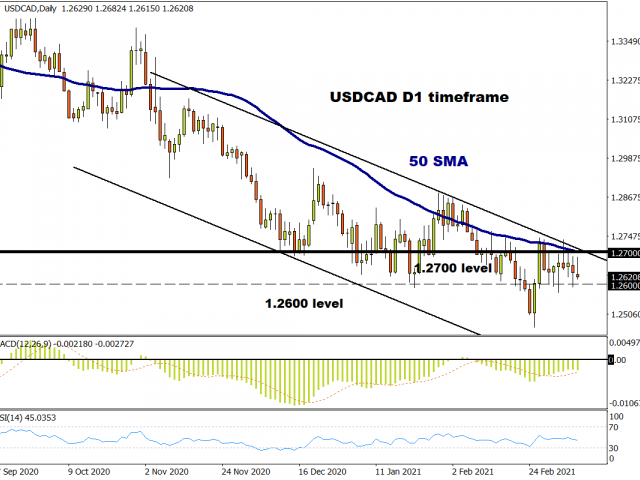

Any positive surprises from the BoC?

The Bank of Canada is expected to leave policy measures on hold later today but may give some directional clues for CAD with a cautiously constructive statement. The stronger than predicted economy and surging oil prices could see a reduction in asset purchases next month as the bank releases its upgraded growth forecasts in April.

Unless Governor Macklem turns more nervous on the outlook and the volatile bond environment, USD/CAD might be tempted to take another look below 1.26, ahead of the jobs numbers on Friday.

Momentum is lacklustre at the moment and the 50-day moving average will try to cap any upside above 1.27.

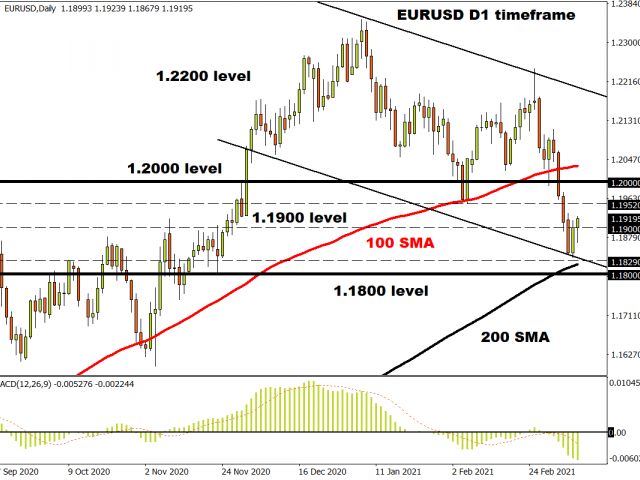

ECB not likely to trouble EUR

The ECB is set to stand pat at its meeting tomorrow with new staff projections seeing an upward revision to CPI forecasts and a modest downward revision to 2021 GDP.

Rising bond yields are increasing the pressure on President Lagarde to better explain her reaction function so traders are hoping for a bit more clarity here, but no new central bank action. A downplay of recent increases in bond yields, similar to other central bankers, is likely.

The euro is mainly being driven by broad dollar sentiment currently, with the 200-day moving average at 1.1832 acting as decent support. Continued failure to hold gains above 1.19 could see another push lower, with a close above 1.1952 needed to ward off the bear.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.