The broadest index of Asia-Pacific shares outside Japan is on course for its biggest jump in two months, after declining on Monday to the lowest level in a year. Data from South Africa show that there has been no surge in hospitalisations or deaths resulting from the Omicron variant’s emergence. This suggests that, so far, it is less dangerous than the Delta variant. Policy easing by the People’s Bank of China is also helping the risk mood. The Chinese authorities are demonstrating a more forceful approach to prevent an all-out domestic property market rout.

BTD continues …

Of the many new acronyms that have been invented over the past few years, we would hazard a guess that “BTD” (“Buy the Dip”) is the one that would have swelled your bank balance the most. There was bit more hesitation compared to when the delta variant emerged, but it seems that Omicron for now has simply provided a big buying opportunity. Bargain-hunters scooped up stocks in the US yesterday which had been hit hard recently, led by travel and airlines.

The S&P 500 posted a decent gain above 1% yesterday having touched the 100-day simple moving average. The 50-day moving average has also been pierced to the upside and now acts as initial support around 4560. Bulls will have their eyes on last week’s high at 4672, within a whisker of the all-time top.

Risk and commodity currencies enjoy the change in mood

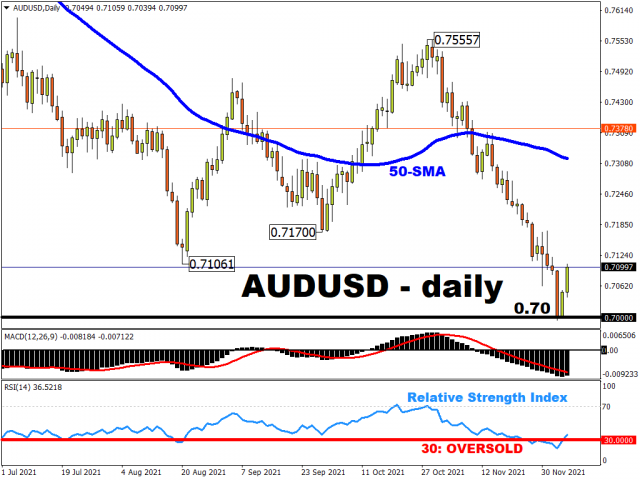

Commodity currencies are outperforming so far this week after taking a battering so far this month. AUD, NZD, CAD are all bid with the yen and swissie underperforming as investors move away from havens. The US dollar is eking out gains with the DXY stuck midrange between the last week’s low at 95.51 and the cycle high at 96.93.

The overnight RBA meeting has also helped the more positive risk sentiment in markets today. The bank left their policy settings unchanged as expected and is set to keep rates at 0.1% and weekly bond purchases intact until at least mid-February 2022. More interesting was their say on the Omicron variant which they believe was “a new source of uncertainty but is not expected to derail the recovery.” Policymakers emphasised household spending and business investment above the new variant.

AUD/USD posted a new cycle low below the key psychological 0.70 level last Friday. The November 2020 bottom sits at 0.6991 which reinforces this level of support. But the pair was heavily oversold, and the bulls are now enjoying two rare days of gains this week. The August low at 0.7106 is the next resistance level to negotiate, then the September trough at 0.7170.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.