CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

A Guide to Stock Indices and how to trade them

This guide delves into the different types of market indices, why it can be beneficial to trade them as CFDs, and covers some popular index trading strategies.

Open AccountTrading is risky.

Why is trading Indices so popular?

For many people who prefer to trade on a market’s price action rather than buying, selling and trading in individual assets of that market, stock indices have become a popular choice. Like forex and stocks, FXTM offers stock index trading in the form of CFDs.

Which one should you choose? Do stock indices offer better conditions than forex or stock CFDs? Here’s a summarised point-to-point comparison of these instruments from FXTM’s perspective:

Types of Indices

The types of indices include commodity, stock, and bond indices. Commodity indices consist of baskets of commodities such as raw materials, precious metals, or agricultural products.

Bond indices are composed of various bonds from the bond markets. A bond represents a unit of corporate or government debt. Bond and commodities indices are not currently offered by FXTM.

Synthetic indices are based on simulated markets, more popularly known as baskets. While they behave like a real financial market, their price movements are created from the use of randomly generated numbers via a secure computer broker. No broker has any control over these numbers, and therefore no influence over the market’s ‘behaviour’. One example of a stock basket is the Social Media Index.

Stock indices are the most popular and actively traded, however, because they consist of a basket of stocks from top companies traded on a particular stock exchange. For instance, the FTSE 100 index (or UK 100) is composed of 100 of the largest firms on the London Stock Exchange.

Indices don't have any intrinsic value, and do not signify a share of ownership in a company.

What is a Mini Index?

A mini index is a collection of assets, just like a regular index. However, a mini index provides a smaller lot size, which therefore means that you need less capital to invest in them. Popular examples of mini indices include the Mini S&P500 and the Mini Wall Street 30, both of which are available to trade with FXTM.

Mini indices are a great way for a new or more cautious trader to invest in major company names, and enables you to diversify your portfolio with less risk to your capital.

Weighting of Indices

Two main methods exist for calculating the index value. They are referred to as index weighting schemes.

Price-weighted Indices

The index price is calculated by taking into account the price per share of each stock in the index. Each stock contributes a fraction to the overall value of the index. Higher priced shares, therefore, have greater weight in price-weighted indices.

Capitalization-weighted Indices

In this scheme, individual items in the index are weighted based on their market capitalization. For instance, if a company has a higher market capitalization (the company’s worth based on its outstanding shares), the value of its shares will contribute more to the index value than more expensive shares from companies with fewer market caps.

How to Trade Indices

There are various ways to trade and invest in financial indices. You may invest in exchange-traded funds (ETFs), index futures, or index options. Investors receive dividends from index mutual funds and ETFs.

The challenge of investing in index funds or ETFs for a retail trader is the high minimum investment amount required by some brokers. There are also management fees to be paid.

The quickest way to get started with indices trading is through trading contracts of differences (CFDs), which is what FXTM offers. You will not own the underlying assets, and there are no dividend payouts. CFDs allow retail traders to speculate on the price movement of indices. Trades take place on the spot index market, which offers a comparable experience to trading forex pairs.

Here are some important indices trading tips before you start:

Adopt the correct trading psychology that prepares you for downturns in the market.

Develop risk management rules that prevent you from entering into low odd trades.

Have a disciplined approach by developing a trading system and sticking to risk management rules.

What are the Most Traded Indices?

Traders are drawn to trading indices that have the most trading volume and higher volatility, so they can profit from the price swings. Stock market indices are fundamentally made up of shares from blue-chip companies or firms with the highest market capitalization.

With FXTM, traders can trade stock indices from around the world. They have high volumes and are closely analysed, which means that you can find economic news releases associated with them.

Stock Indices

Stock Baskets

It is also possible to trade stock baskets, which are not your typical stock index but are offered as an index, alongside currency baskets. Currency baskets do not contain any stocks at all, whilst stock baskets do contain a weighted price average of a number of shares based on theme or industry (very much like your traditional Index ETFs).

FXTM currently offers The Social Media Index, The Space Wars Index, The Green Index, Mobile Index and Vegan Index.

Index Trading Strategies

The advantage of CFD indices markets is that you can use tried and tested techniques used in forex or stock trading as part of your technical trading strategy. Here are some technical index trading techniques you can start implementing as a beginner.

Support and Resistance

Developing the skills to identify potential support and resistance levels is a fundamental skill that you learn in technical analysis. Both represent levels where the price seems to rise and fall to, but never surpass.

The typical strategy for trading with support and resistance is to buy when the price during an uptrend falls to the support line. The trader anticipates a bounce back towards the upward direction. Alternatively, during a downtrend, the trader sells when the price reaches the resistance level in anticipation that the index will trend downwards.

Support and Resistance RevealedTrading the Trend (Trend lines)

Example of the NASDAQ chartTrendline trading is particularly useful when trading stock indices as CFDS. For instance, an index such as S&P 500 trends up over the long run.

Overtime economies keep expanding. Companies innovate and embrace new technologies, which leads to long-term growth. Share prices keep rising.

There are various ways of identifying trends, such as plotting high lows and low highs or using various indicators like the Moving average and the momentum indicator.

Identifying Trends: A Beginners’ GuideMoving average

Using moving averages to trade indices helps you pinpoint the overall trend of the market without the noise of day-to-day price movements. Moving averages can be defined as lines that are based on the average closing price over a given time frame.

There are various popular time frames used for moving averages, including 10 days, 20 days, or 50 days. The moving average provides support and resistance levels. For instance, during an upward trend in the market, the price tends to bounce upwards after testing the moving average.

Scholastic Oscillators

Another simple and effective indicator to apply when trading Indices is the scholastic indicator. It's a simple tool for beginners because it entails two lines: %K and %D. It's fundamentally used to determine if the market has been overbought or oversold.

Traders mainly look at the %D for trading signals. It's called an oscillator because the lines oscillate (move up and down) with the price movement.

There are two types of scholastic oscillators: fast and slow. The fast scholastic oscillator tends to produce more false signals as it's more susceptible to noise.

By tweaking the formula, the slow stochastic was introduced, and it smooths out the price action to produce better signals.

Trade indices like a pro by also learning about these technical trading indices strategies and indicators

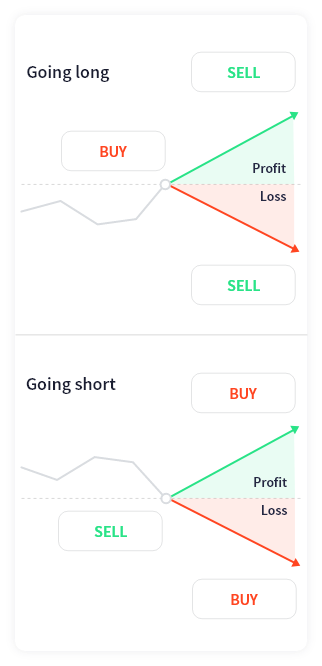

Go Long or Short

The basic premise of CFD indices trading is choosing whether to go long or short. After applying your index trading strategy, you may come to the conclusion that it is favourable to buy the index and enter into a long position. You then hold on to the index in anticipation that its price will increase. If it does, you close the position at a higher price and make a profit.

Going short on an index means that you anticipate that its value will fall, maybe due to an upcoming unfavourable economic news release.

You may not have the ability to execute long and short positions in CDS index trading or ETFs index trading.

Trade with Leverage

Trading indices as CFDs gives you access to leverage. Leverage is the ability to open a position worth a large amount (e.g. $20,000), but by using a smaller amount of your own capital (e.g. $500) to do so.

FXTM offers a variety of leverage levels depending on the index you’re trading, which allows you to take maximum advantage of profitable indices trading signals. But note that while leverage bolsters your earning potential on successful positions, it also multiplies the risk on your capital.

Hedge Your Existing Positions

The concept of hedging open positions may be implemented into your broader stock indices trading system to manage risk. Hedging simply allows you to open opposing positions on live open trades.

Hedging has a number of benefits enabling you to lock in profits and limit losses on an open trade. When trading indices CFDs on FXTM, there is a hedging option in MetaTrader 5.

Alternatively, you can manage risk using trailing stops. Setting trailing stops is an automated method of moving the stop loss.

FAQs About Trading Indices

FXTM offers the capability and resources you need to start trading indices. Before you get started, here are some frequently asked questions from beginners.

What does indices trading mean?

Trading indices means trading a collection of assets (usually company shares) as a single product. FXTM offers indices trading as CFDs, which allow you to make potential profits by investing small amounts with the advantage of the broker’s leverage to open large positions. CFDs trading is also easier to understand than trading indices as futures or funds. You don't need a separate company or fund manager to make the trades on your behalf.

Can I profit from indices trading?

You can potentially profit from trading indices. The strength of successful long-term traders is not in their ability to make many winning trades. These traders may average winning percentages that range from 50 to 60%. They aim to ensure that they lose less money than they make on profitable trades.

Why is the stock market index important?

The stock market index is important because stock indices reflect the market performance of the top companies in a stock exchange. Plenty of traders pay attention to it even if they are only trading stocks. Indices can also indicate a country's economic performance.

Which stock market index is the best indicator?

There are various stock market indices depending on the market you choose. The most popular indices tend to feature securities from the largest companies, such as the DAX, Euro 50, S&P 500, and FTSE 100.

What is the best way to analyse a stock market index?

The best way to analyse a stock market index is to incorporate fundamental, sentimental, and technical analysis. Traders should factor in the key economic releases that affect the stock market. Global events such as the COVID-19 pandemic should be considered.

Announcements on key decisions of companies in an index may also have repercussions on the index value. For instance, the 5th Apple stock split (where 1 share was split into 4 shares) impacted the Dow Jones Industrial Average that’s based on price-weighting. The share price of Apple fell from $500 to $125.

How Can FXTM help me if I wish to trade indices?

FXTM offer a superior indices trading experience. We have many technical analysis tools and indicators available which can help you to generate precise index trading signals.

Our economic calendar will keep you updated with major economic events so you can leverage fundamental analysis. Updates from our market analysis team will also help you uncover trading opportunities.

By taking advantage of our demo trading accounts, you can develop your own indices trading system. Traders also have access to an advanced strategy tester via the MetaTrader 5 platform. It allows you to test the performance of traditional trading robots (Expert Advisors). This helps you pinpoint the actual performance of various index trading systems.

We have also curated additional MT4 forex trading indicators that you can download. Our traders access high-quality educational resources such as webinars presented by industry experts.

FXTM Account Types that offer Stock Indices

To see which FXTM account types offer index trading, have a look through their pricing comparison, and click on the account name for more information on other trading conditions.

*Spreads are floating and they may increase during specific periods of the day depending on the market conditions. They also vary depending on the index you’re trading, so it’s best to always check the contract specifications of the particular index you’re interested in.