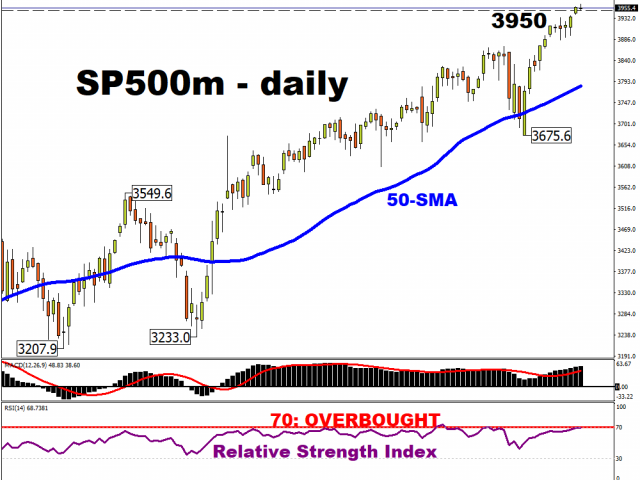

The reflation trade is in full effect at the moment as encouraging vaccine news, accommodative economic policies and better-than-expected earnings are all contributing to the positive mood. In fact, global stocks have now reached a thirteen-day winning streak, the longest since 2003. Asian equity markets surged northwards overnight with the Nikkei hitting multi-decade highs once more above 30,000. European markets are consolidating their hefty gains from yesterday, as traders await the opening of US indices after the public holiday on Monday. Futures are pointing to a modestly higher open and more new highs.

Bond yields screaming higher

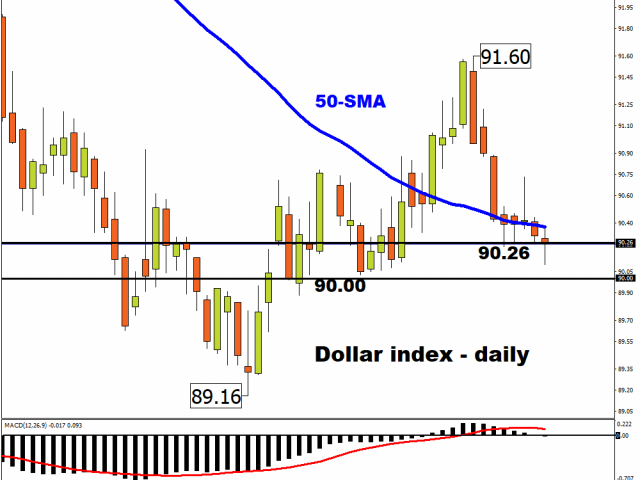

This environment is notably bad for bonds and US 10-year yields have burst through 1.25%, with the March liquidity squeeze top at 1.27% now on the radar. The divergence between rising inflation expectations (more than 2%) and subdued real yields (-1%) remains, which means the dollar is also struggling. It now looks to have lost near-term support around 90.26 and is heading towards key January lows around 90. The risk-on theme looks set to continue with cyclical commodity FX topping the major currency charts this month.

UK assets in favour

One market standing out currently is the FTSE 100 which is up more than 5.6% this month. With the Brexit risk premium gone and the impressive rollout of Covid vaccines (23% of the UK population have now received a dose of Covid vaccine), UK indices, which have been undervalued for some time, are now gaining momentum. Of course, the FTSE is being helped by the fact that it is top heavy with “value stocks” in banking, energy and mining sectors which investors are leaping into on the back of the healing global economy.

Technically, the index is still below pre-pandemic levels and even the highs from January just above 6,900. Consolidation today is a positive phase for the market after such a big move yesterday, and before it can push to new year-to-date highs. Momentum indicators are not overbought and if prices can hold above the 100-week moving average, then its full steam ahead to 7,000 and beyond the 200-week moving average.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.