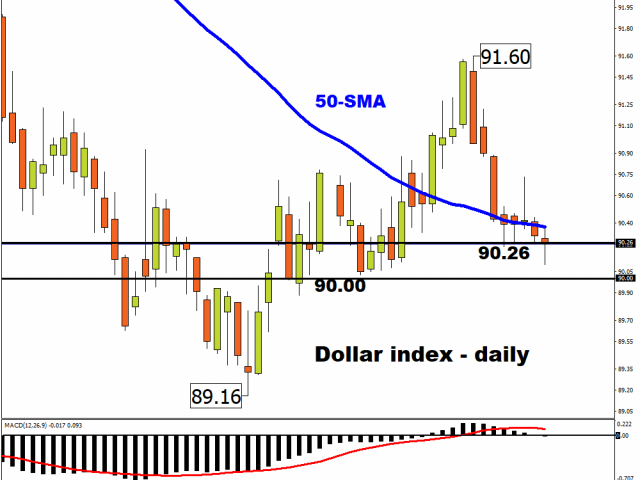

The Dollar got hammered today.

It was bullied by G10 currencies as Treasury yields lingered near their lowest level in five weeks.

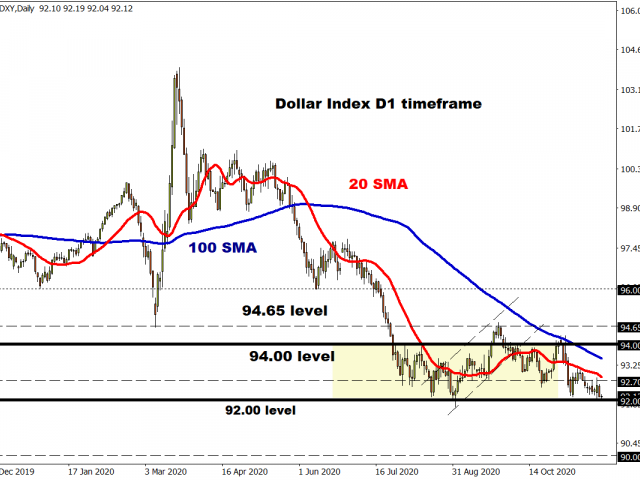

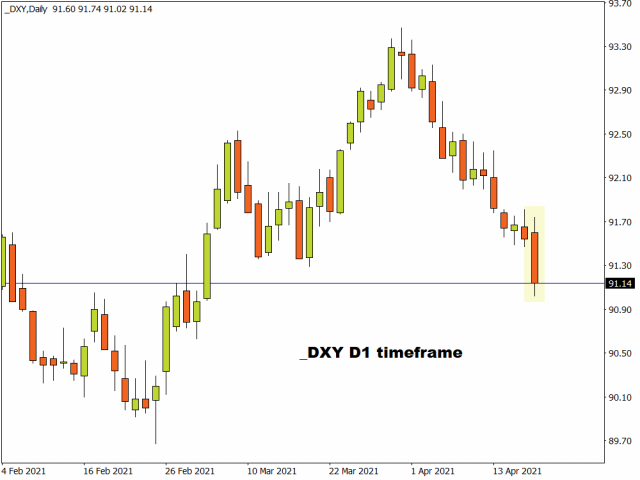

In our morning report, we highlighted how strong economic data from the two largest economies in the world was likely to fuel the risk-on mood. Well, this has compounded the Dollar’s woes – further denting appetite for the safe-haven currency. The Dollar Index (DXY) has fallen to its lowest level since early March, wobbling around the 91.10 level as of writing.

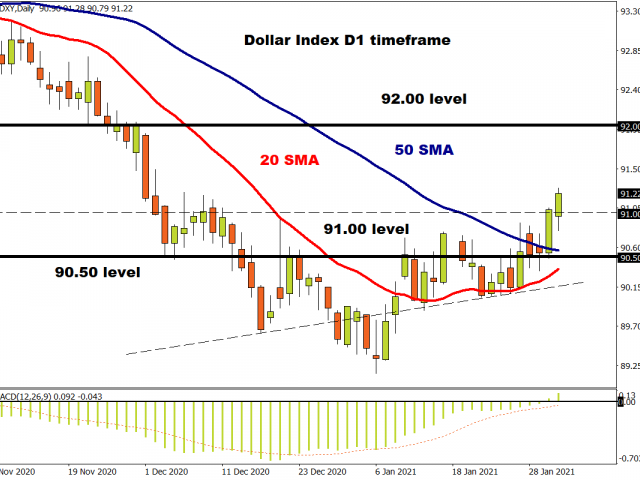

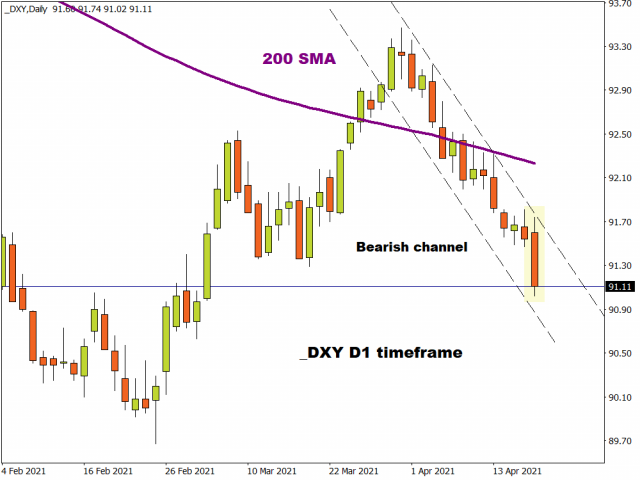

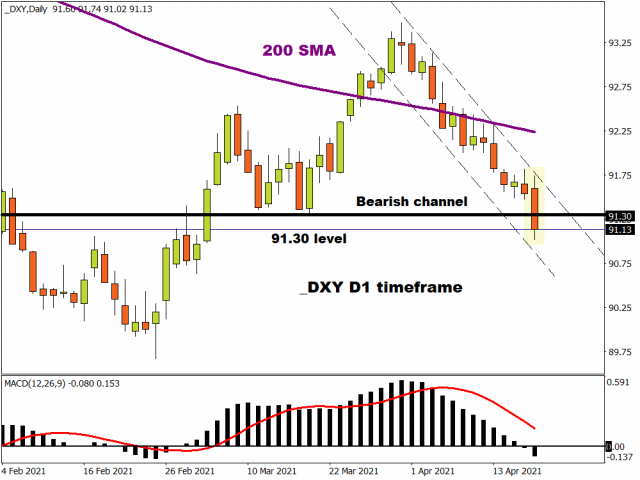

With the DXY trading below the 200-day Simple Moving Average (SMA) and residing within a bearish channel, the path of least resistance points south. But it does not end here.

The MACD has crossed below the zero line which is considered bearish while prices have cut through the 91.30 support like a hot knife through butter.

A solid daily close below 91.30 could encourage a decline towards 90.80, 90.20, and 90,00 respectively.

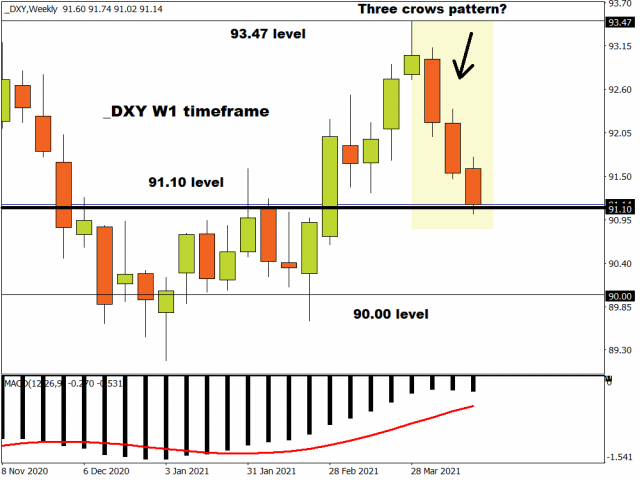

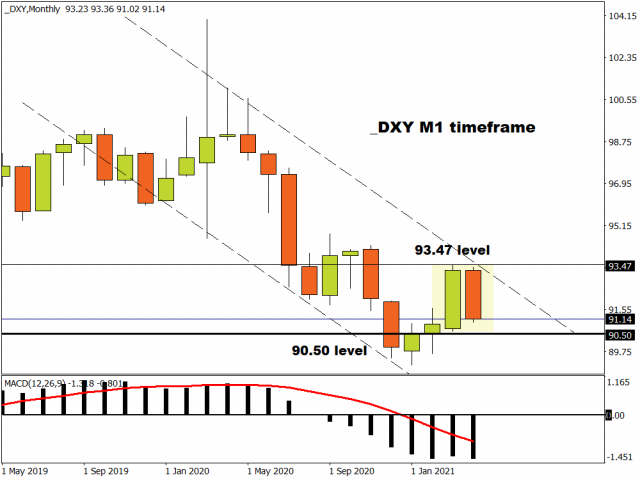

Taking a look at the weekly timeframe, a similar picture is playing out. Things have gone downhill for the DXY since bulls failed to push prices beyond the 93.47 level. If the DXY concludes this week negative, we could see a three crows pattern formation that signals the reversal of a trend. In this case, such a development may mark the end of the bullish trend that started after prices secured a weekly close above the 91.10 lower high.

Zooming out into the monthly, April’s monthly candle could produce a bearish engulfing pattern. Such a pattern tends to occur at the start of a downtrend or to signal the continuation of the current trend. For this setup to materialise, a monthly close below 90.50 needs to be achieved.

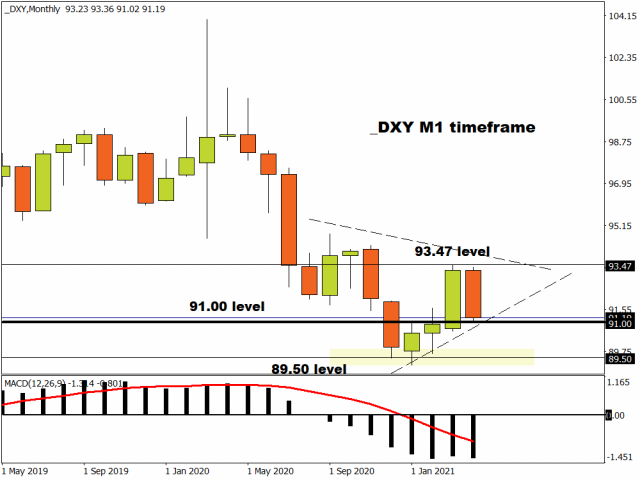

Is there still hope for bulls?

Bulls certainly have a very steep hill to climb to reclaim back some control. If the downside momentum fizzles out around the 89.50 support level, this could provide a foundation for bulls to push prices back towards 91.00 and higher.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.