It is official.

After more than four years of drama and uncertainty, the United Kingdom and the European Union have finally reached an agreement on terms of a post-Brexit deal.

This is a historical development that is set to lift sentiment and remove a layer of uncertainty for the UK ahead of the New Year. Considering how this agreement comes less than a week before the transition deadline, investors and businesses are breathing a sigh of relief. Given how the trade agreement has to be ratified, the two sides now face a race against time to put the trade deal into law.

For the time being, the deal will allow tariff-free trade to continue between the UK and the EU – a welcome development for business on both sides of the English Channel. However, the UK can eventually expect widespread new barriers to trade and even travel with the European continent – a discussion for another day.

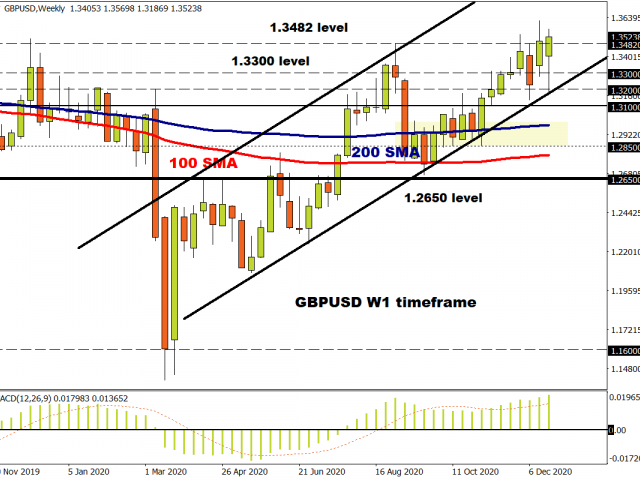

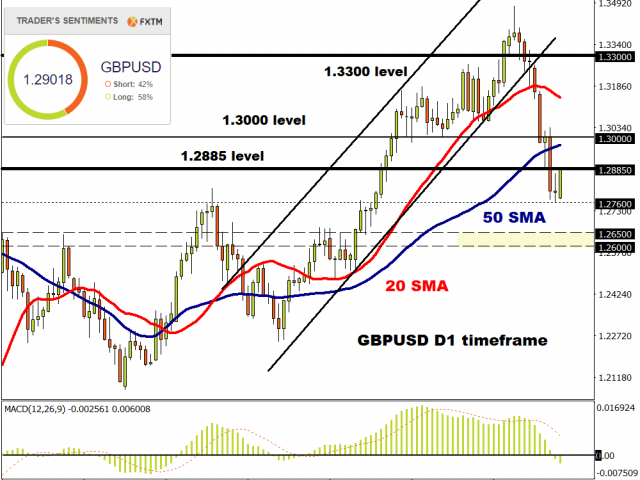

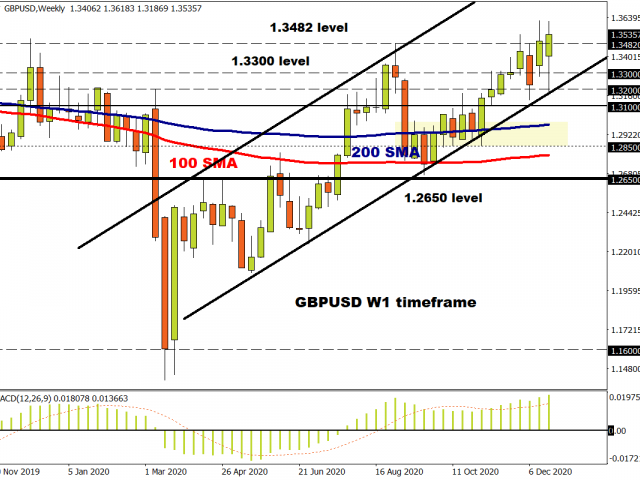

Looking at the technical picture, the GBPUSD offered a muted reaction to the announcement before later slipping against the Dollar. With the agreement largely priced in, the Pound could be experiencing some profit-taking ahead of the Christmas holiday. Prices still remain bullish on the weekly timeframe. A weekly close above 1.3500 could open the doors towards 1.3650 and higher. Should 1.3500 prove to be unreliable support, the GBPUSD may slip towards 1.3300.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.