It was a trading week jampacked with speeches from US central bank officials.

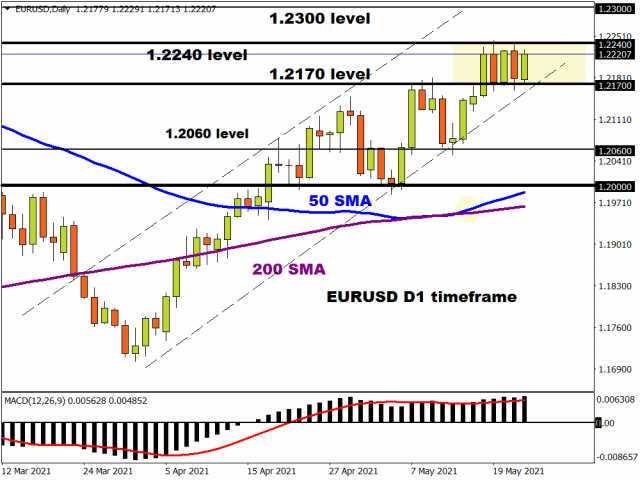

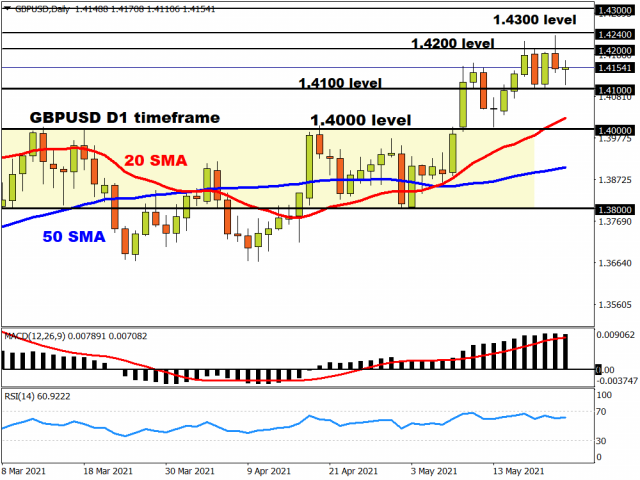

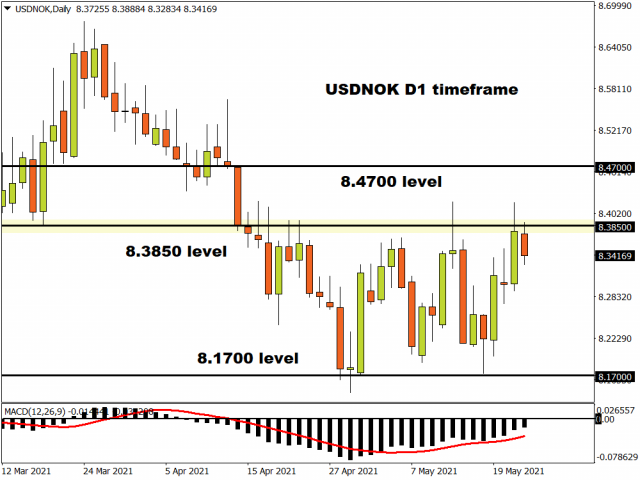

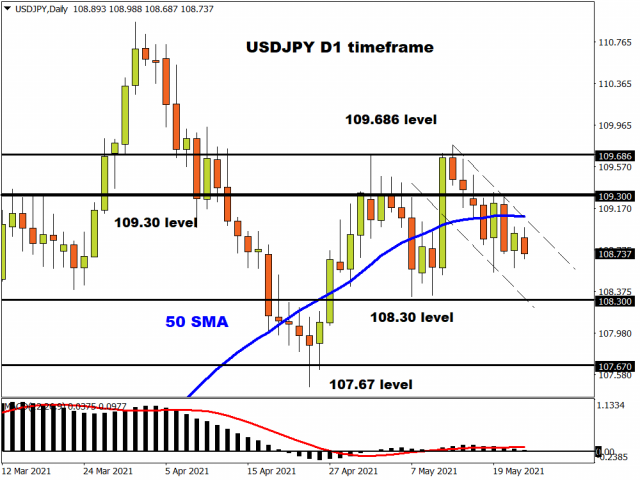

Monday kicked off on a cautious note as investors weighed the explosive volatility in cryptocurrencies from the previous week. Other than the little action seen on the Norwegian Krone and New Zealand Dollar, it was a dull start to the trading week for G10 currencies. In our technical outlook, we covered potential trading setups on the Dollar Index, EURUSD, GBPUSD, USDNOK, and USDJPY for the week ahead.

Risk sentiment improved on Monday evening after a chorus of Fed officials reiterated that the recent pickup in inflation would be transitory. Equity bulls cheered on this development with Asian markets painted green on Tuesday after technology shares led gains on Wall Street overnight.

The tired dollar extended losses, sinking as low as 89.52 as Treasury yields slipped amid expectations that the Federal Reserve will keep its monetary policy accommodative. Mid-week the Dollar fought back, staging a rebound that elevated prices back above the 90.00 level.

Our trade of the week was Amazon. The American multinational technology company has agreed to buy the historic Metro-Goldwyn-Mayer (MGM) movie studios for $8.45 billion. Given how MGM is one of Hollywood’s most famous studious, this is certainly a big deal. Amazon stocks have gained over 1% this week.

Things started getting interesting mid-week after some Fed officials signalled that they were open to starting the taper debate. Federal Reserve Vice Chair Richard Clarida said that the Fed may begin taper talks at upcoming policy meetings. San Francisco Fed President Mary Daly on Tuesday indicated that the Fed may start “talking about talking about tapering while Fed Governor Randal Quarles signalled on Wednesday that he was open to taper talks. These comments certainly impacted markets mid-week and fuelled speculation over the taper talks gathering momentum.

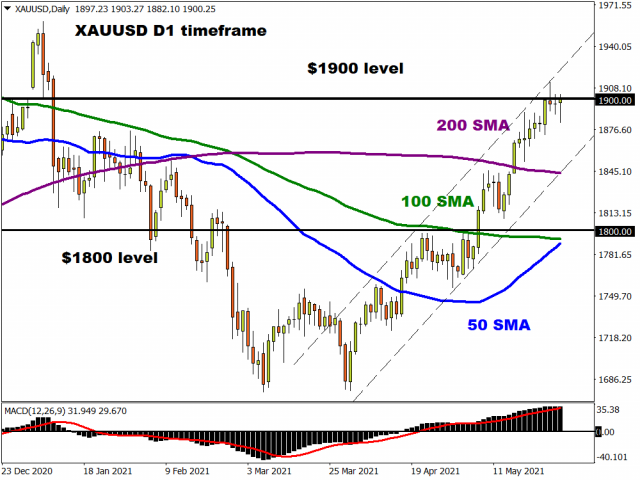

In the commodities arena, Gold was the star of the show after blasting above the psychological $1900. The precious metal derived strength from a weaker Dollar, inflation fears, and real yields remaining in deeply negative territory. However, bulls failed to secure a solid daily close above the $1900 level. With Monday 31st marking the final trading day of May, it will be interesting to see if bulls have enough strength to secure a monthly close above this psychological level.

On Friday, global equities traded mostly higher as investors eyed the unveiling of US President Joe Biden’s $6 trillion budget proposal for 2022.

In other news, the core PCE which is the Fed’s favoured measure of inflation posted its biggest year-on-year jump since 1992 in April. The core PCE index which strips out volatility caused by movements in food and energy prices rose 3.1% last month compared with a year ago. This was higher than the 2.9% estimate and is likely to fuel worries over rising prices. Growing concerns over inflationary pressures may heighten speculation around the Federal Reserve acting sooner rather than later.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.