It was certainly another eventful week for financial markets.

Despite the slow start on Monday, there were plenty of major economic releases and developments that kept investors occupied throughout the week. One of the major topics across markets was the OPEC+ drama that left many guessing over the future of the cartel’s output deal.

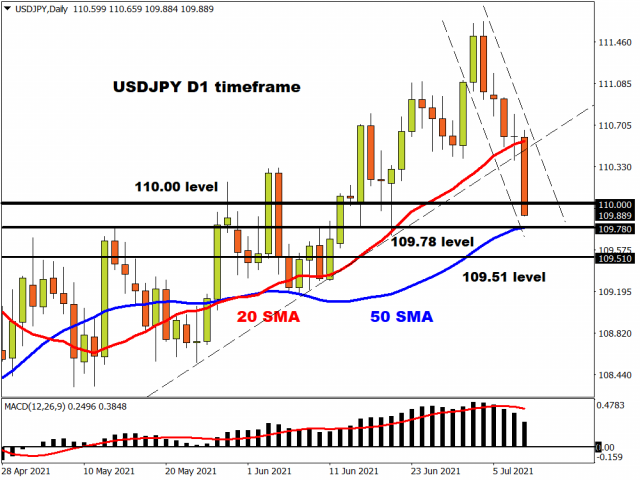

In the currency space, king dollar took a backseat to kick off the week with the DXY descending closer towards the magnetic 92.00 support level.

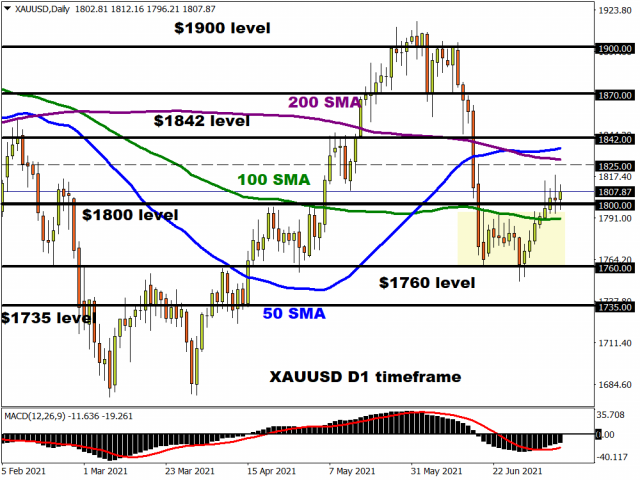

On Tuesday, we briefly discussed the scenarios that could play out after OPEC+ abandoned output talks with no new date set for more discussions. Gold also caught our attention after appreciating above $1800 amid a weaker dollar and easing concerns over the Fed raising interest rates sooner than expected.

Some focus was directed towards the Eurozone retail sales and German data. Eurozone monthly retail sales beat expectations in May after a drop in April while the German ZEW Economic Sentiment tumbled to 63.3 in July, down from 79.8 in the previous month.

Our trade of the week was crude oil which hit its highest level since November 2014. Despite oil prices later depreciating as the OPEC+ uncertainty lingered, WTI crude is still up over 53% year-to-date while Brent crude is trailing behind gaining almost 46%.

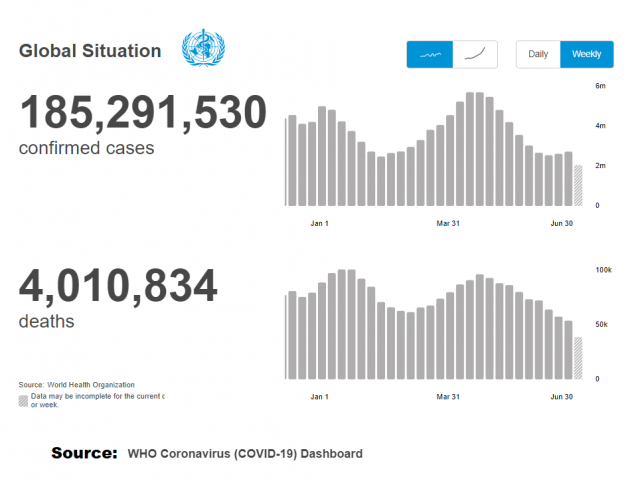

As the week progressed, the sentiment pendulum swung into “risk-off” territory amid rising concerns over the reflation trade, slowing economic data, and the Delta variant. There was action in the bond markets as yields on the US 10-year Treasury tumbled in response to worries over global growth.

It was all about the FOMC meeting minutes on Wednesday evening. The minutes delivered no surprises and painted quite a nuanced picture in contrast to the hawkish outlook and dot plot in June's policy meeting. Although Fed policymakers talked about tapering, officials were not ready to provide a timeline thanks to uncertainty over the economic outlook.

The developments in the bond markets hijacked headlines on Thursday after the 10-year U.S Treasury yield tumbled as low as 1.248%, its lowest level since February.

Investors were clearly on edge with the mood across markets gloomy as the rapid spread of the Delta variant set off alarm bells across the world. The global death toll from Covid-19 has surpassed 4 million.

Interestingly, equity bulls returned to the scene on Friday as the sentiment pendulum swung in favour of risk as growth concerns eased. Treasury yields staged a rebound from multi-month lows while the S&P 500, Dow Jones and Nasdaq closed at record highs.

In the commodities arena, gold concluded the week above the $1800 level. Focusing purely on the technical picture, a move towards $1825 is looking like a possibility in the near term. If gold bugs can push prices beyond $1825, the next key levels of interest can be found at $1842, $1870, and $1900. If prices sink back below $1800, a decline towards $1760 and $1735 could be on the cards.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.