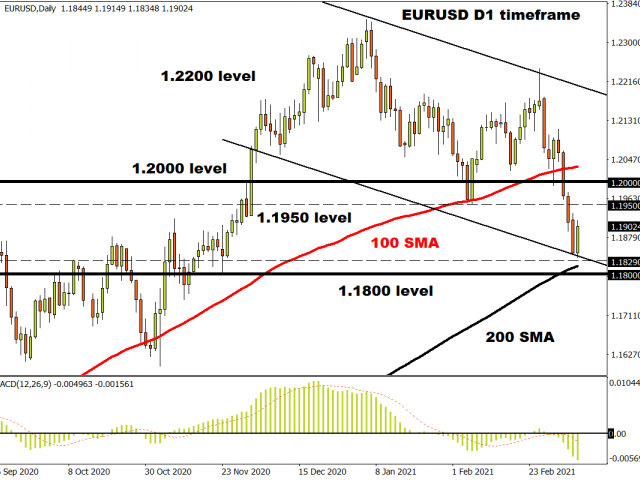

It looks like it’s “rotation” Tuesday again as US stocks paint a mixed picture – Nasdaq and stay-at-home stocks are in the green while the Dow is suffering. This is all down to two news stories, the first being the US CPI data which jumped as forecast but wasn’t at the highest end of estimates. Energy costs rose over 13% y/y but at first glance, the market is fairly sanguine and appears to be looking through the figures as transitory. Many economists are not too sure and see rising prices closer to 4% in the not-too-distant future. That means the rate hike priced in at the end of 2022 is about right, but the Fed don’t agree judging by the recent speakers.

Don’t fight the Fed

The dollar is lower as higher inflation readings are seemingly par for the course as far as the Fed is concerned. They have been arguing that significant spare capacity means these numbers will drop back towards its 2% target in due course. Bond yields are also lower having popped higher on the J&J news. If housing prices especially continue on their upward path, together with rapid job creation, then the Fed may have to change course, but “Don’t’ fight the Fed” is a phrase that has stood the test of time!

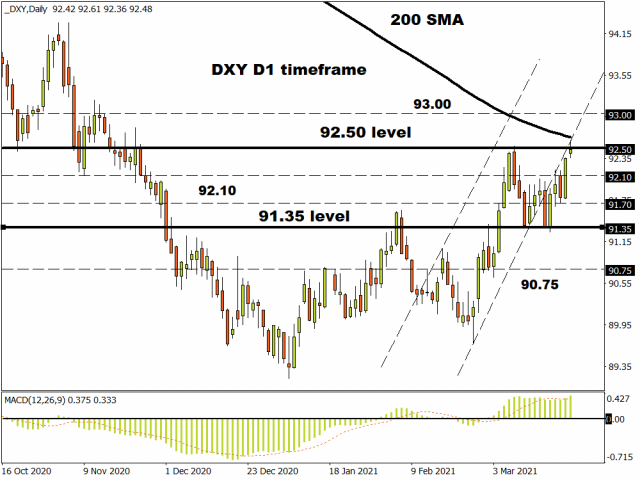

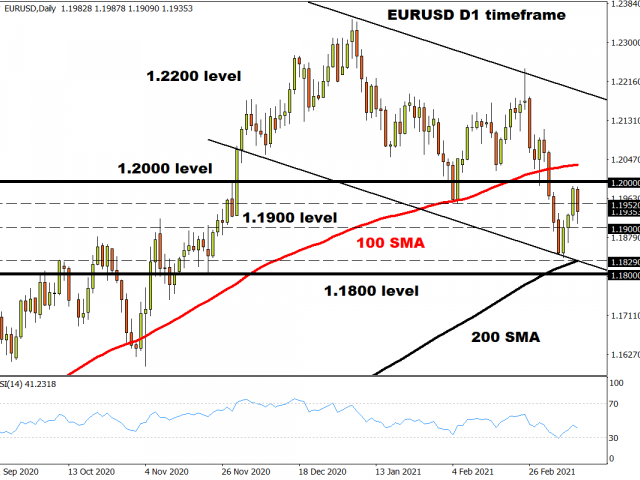

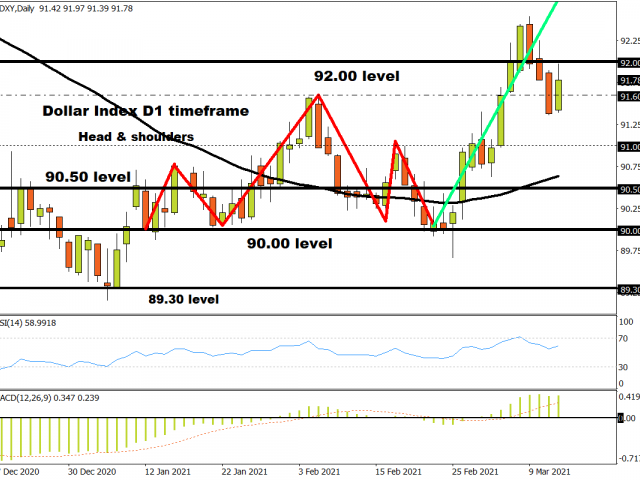

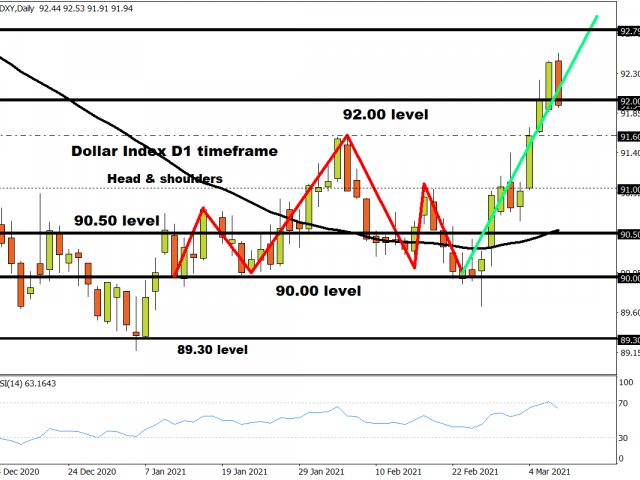

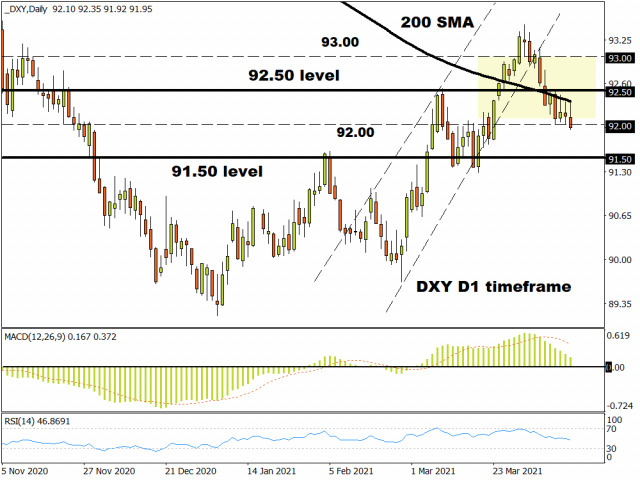

Dollar rolling over

The withdrawal of the Johnson & Johnson vaccine is a blow to the ongoing reopening of the world’s biggest economy. We said last week that USD was at an important juncture and the 200-day moving average looks to be capping any upside. A strong close below 92 could see the DXY break its recent narrow range and move towards 91.50 in the near term.

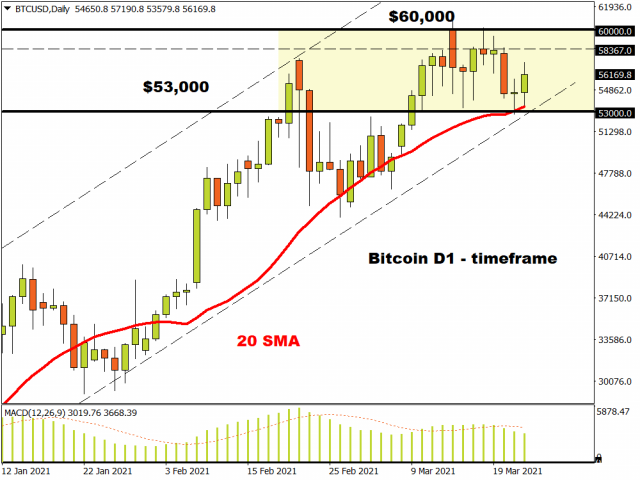

Bitcoin hits new record highs

The premier cryptocurrency looks to be breaking out in a textbook fashion. We’ve seen a series of higher highs and higher lows since January with the 50-day moving average supporting prices along the way. After cracking $60,000, prices have now pushed above $63,000 with the public offering of Coinbase adding to the euphoria of cryptos in general.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.