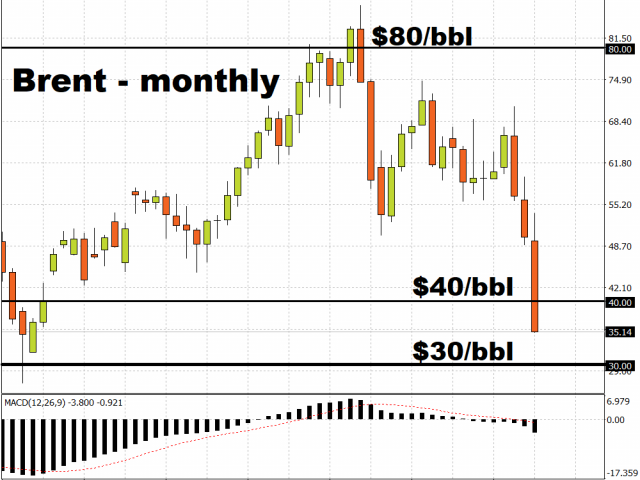

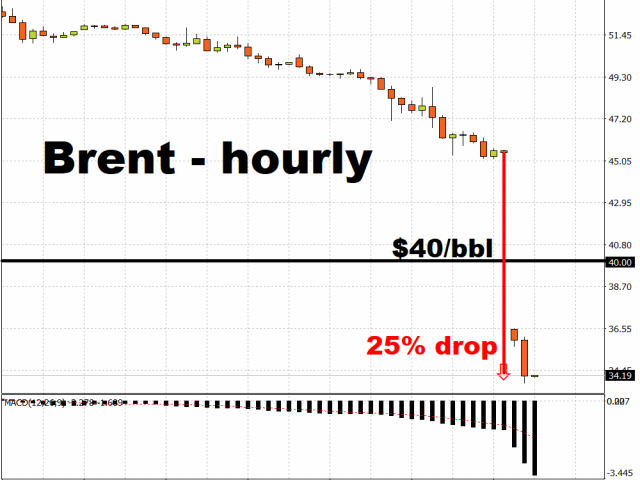

The $40/bbl floor has given out below Brent Oil, which is now trading around its lowest levels since February 2016, after Saudi Arabia slashed its official prices by the most in some 20 years. The OPEC+ alliance appears to be crumbling, after major Oil producers failed to reach consensus over further supply cuts. That, in turn, has paved the way for a price-war, as nations shift their focus towards defending market share instead.

The apparent abandonment of the concerted effort to shore up prices is set to push global Oil markets into oversupplied conditions. As worldwide demand continues being eroded by the coronavirus outbreak, the risk of sub-$30/bbl Brent is looming large.

With Oil prices languishing at such levels, this is likely to erode support for Oil-linked currencies, such as the Norwegian Krone, the Russian Ruble, the Mexican Peso, and the Malaysian Ringgit over the near-term. The ability of Oil-dependent nations to fund their respective fiscal programmes this year are likely to be thrown into further doubt, should Oil prices fail to recover meaningfully in the coming months.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.