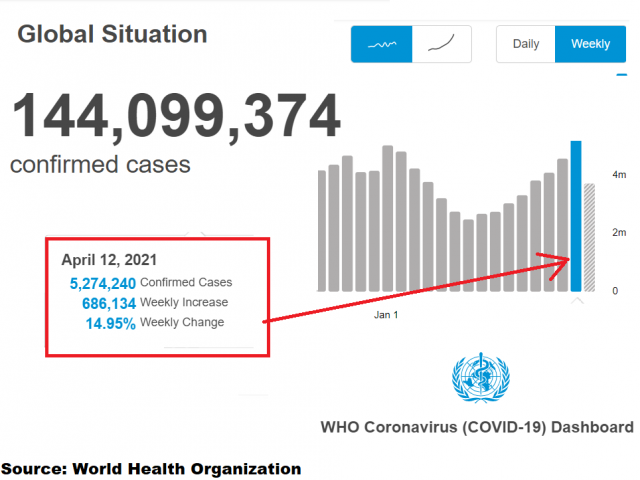

Investors kicked off Monday in a cautious mood as the Covid menace hijacked the headlines.

According to the World Health Organisation (WHO), the number of new global coronavirus cases surpassed 5.2 million last week – the most in a single week since the pandemic began.

It did feel like a sluggish start to the week, especially when considering how the calendar was void of any major economic releases from the United States, United Kingdom, and Europe.

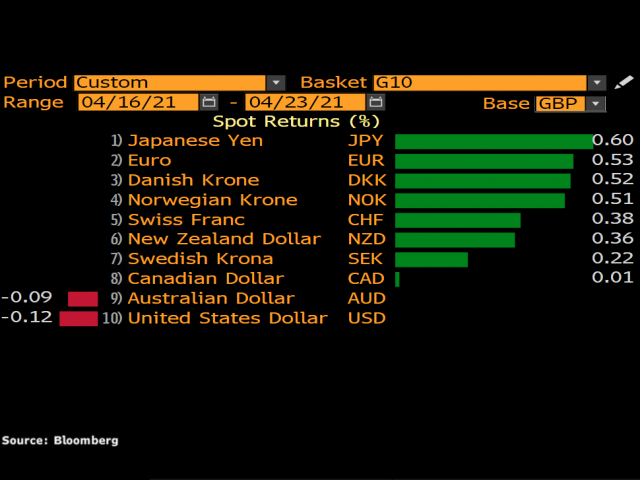

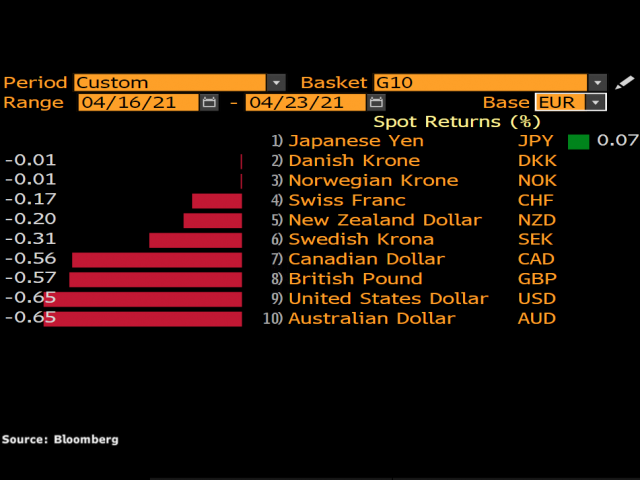

In our technical outlook, we covered the not so mighty Dollar which got hammered by G10 currencies. The Dollar Index (DXY) has shed roughly 0.7% this week with prices trading around 91.06 as of writing. With the fundamentals favouring a weaker Dollar and the technicals illustrating a bearish picture, further losses could be on the cards for the rest of April.

Our stock of the week was Netflix which released its Q1 earnings after US markets closed on Tuesday. Let’s just say that the company kicked of FAANG earning season with a disappointing report after subscriber additions fell well below Wall Street estimates.

Another currency that caught our attention was the British Pound. Pound bulls were on a tear on Monday, trampling most major currencies amid the recent easing of lockdown restrictions and roll-out of Covid-19 vaccines.

However, bulls were unable to maintain the momentum with the Pound later weakening across the board.

We highlighted how the 1.40 level will be a tough resistance to crack on the GBPUSD. Sustained weakness below this level could invite bears back into the game.

Mid-week, Canadian Prime Minister Justin Trudeau announced that the country will keep its border restrictions for another month.

Equity bulls were back in action on Wednesday despite the concerns over rising Covid-19 infections in Asia. Although investors may turn to robust earnings and encouraging data to elevate equity markets, the Covid-19 fears could sap risk appetite. The S&P 500 is down roughly 0.8% this week and Nasdaq has lost over 1%.

The mood across markets soured on Thursday following reports that President Joe Biden could raise capital gains tax for the wealthy. According to Bloomberg, Biden is considering nearly doubling tax to as high as 39.6% on individuals earning $1 million or more.

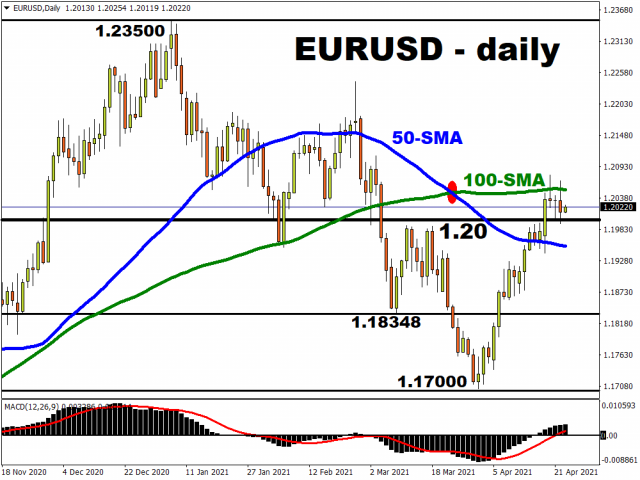

In Europe, the European Central Bank (ECB) kept monetary policy unchanged as widely expected. The Euro has appreciated against almost every single G10 currency excluding the Japanese Yen this week.

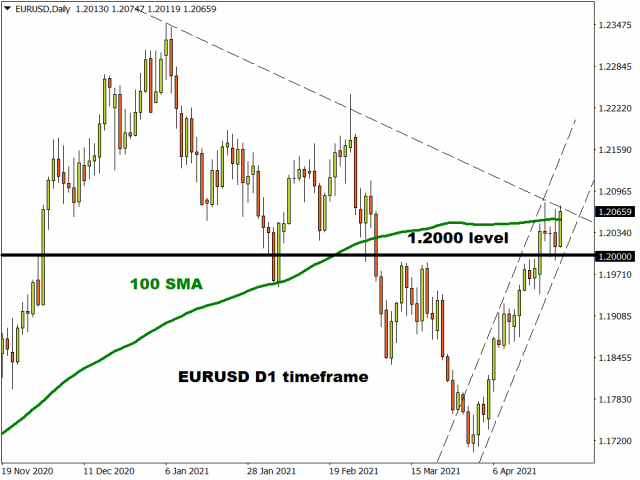

Looking at the technical picture, EURUSD is bullish on the daily chart. Prices are likely to push higher if 1.20 proves to be reliable support.

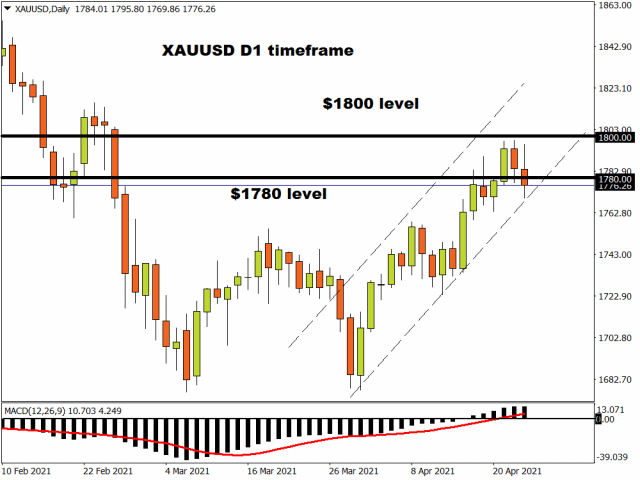

In regards to commodities, it has been a choppy week for Gold. The commodity is basically flat for the week despite being supported by a softer Dollar and falling Treasury yield. With surging Covid-19 cases in Asia fostering a sense of caution and the Dollar still under pressure, Gold could rebound in the week ahead.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.